The price of lithium in China falls 30% in recent months and opening the doors to lower prices in electric cars

The price of lithium in China falls 30% in recent months and opening the doors to lower prices in electric cars

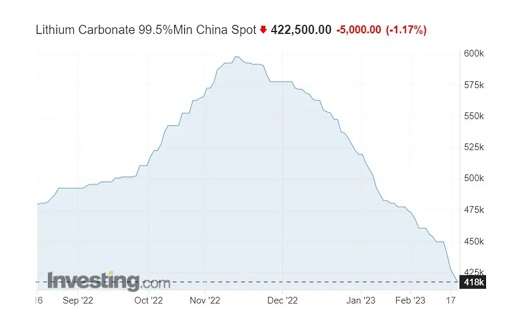

The beginning of last year has been very turbulent, something that skyrocketed the price of materials such as lithium to figures never seen before. A real rally that seems to have come to an end, at least if we look at the figures from the main world market, where its price has fallen by almost 30% in the last three months.

According to the Fastmarkets pricing agency, lithium carbonate prices have fallen 29% from the November highs, when they were trading at 595,000 yuan per ton, and 81,300 euros at the exchange rate, currently reaching 418,000 yuan per ton. A downward trend is driven by concerns about the strength of demand for electric vehicles in Asia’s largest economy.

One of the keys to this concern lies in the legislative changes in China and the impact that the reduction in subsidies for electric cars will have on demand, which adds to concerns about the possible bursting of the country’s real estate bubble.

Lithium prices have skyrocketed since mid-2021 as skyrocketing sales of electric vehicles sparked a scramble between car and battery manufacturers over the metal. But the decline in Chinese demand has raised questions about the possible excess production.

Despite recent declines, Chinese lithium prices are still eight times above the level at the end of 2021, and experts say they have to fall much further before they come close to the cost of production in even the most expensive mines.

At the moment it is too soon to know if the Chinese market will slow down, but in January, sales of electric cars suffered a somewhat weak start to the year, with sales that have fallen by 6.3% compared to the beginning of 2022. A situation where there may be some conditions such as the change in aid programs, but also the arrival of the lunar new year, which usually leads to a reduction in sales due to the march of millions of people to their vacations.

Among the consequences of this fear of a drop in demand is the recent offer from the world’s largest battery producer, CATL, which has committed to a 57% reduction in the cost of lithium with its most important clients.

A situation of low sales in China that some heavyweights in the industry indicate is temporary. This is the case of the giant Albemarle, the world’s largest lithium producer, which maintains its bullish estimates on electric car sales.

According to a report published last week, the demand for electric vehicles in China would grow 40% this year compared to the previous one, which is equivalent to an increase of 3 million vehicles, and that would bring the annual figure for the Chinese market of about 8 million units.

Two factors that seem to separate their paths for the moment, the production of electric cars and the price of lithium, which will mean reinforcing economies of scale, and will encourage manufacturers to apply discounts on their vehicles if they do not want to be left behind in terms of sales that despite the concerns, it seems that they will continue their growth.

Related Post