87% of current customers will buy a Tesla again

For brands that can hold onto their consumers while saving them the trouble of finding new ones, and the loyalty rate is an essential component. A signal that also indicates how satisfied customers are with their products and how competitive they are with their competitors. And the most recent statistics show how well Tesla performs.

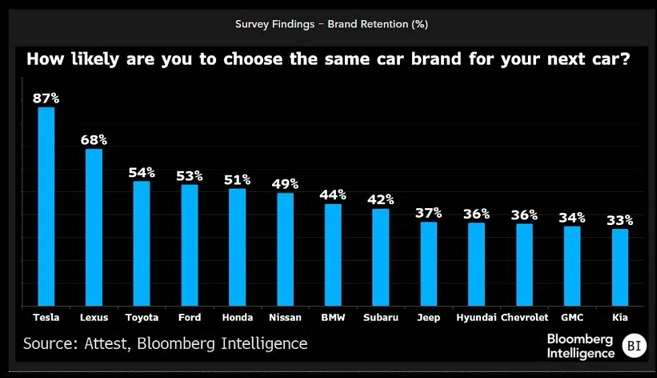

That was reported by Bloomberg and demonstrates that 87% of Americans are devoted to Tesla in a report. A number that we may contrast with the market’s industry average of 65%.

This 87% is especially significant because it happens when US sales of electric cars are declining. In a market where growth is halting, the sales share becomes crucial.

Bloomberg claims that one indication of these numbers is the lack of competition for Tesla in the electric vehicle market. It isn’t losing market share to businesses like Ford, GM, Kia, and Hyundai for its strong retention rate.

Based on data from Bloomberg, Lexus and Toyota have higher customer retention rates than Tesla (68% and 54%, respectively).

Conversely, brands with low rates—like KIA, where just 33% of consumers think they will return, GMC at 34%, and Chevrolet at 36%—are found on the other end of the spectrum.

Furthermore, 81% of US consumers who would purchase a Tesla are new consumers who move from other brands to rival products. Once more, these are very positive figures for Elon Musk and quite negative for other companies like Ford or General Motors, whose clientele is steadily defecting to the competition.

Opinion

The question is whether Tesla is outperforming its rivals or just as well. The answer is complex and might spark a lengthy discussion because, on the one hand, Tesla offers a highly developed product with efficient models, reasonably priced, feature and cutting-edge technology.

However, elements like Elon Musk’s negative perception of the business, unimpressive interior finishes, designs that are too simple for many consumers, and other elements like patchy upgrades can either improve or worsen performance. It comprises fundamental elements, such as lights or wipers for the windshield.

A Tesla dominates the market in the US thanks primarily to the government’s massive barriers to entry for Chinese goods and the apathy of the big traditional groups, but that is heading toward an incredibly complicated situation in markets like China where competitors are introducing better products at even lower costs.

The question is whether Tesla will be able to capitalize on its positioning and characteristic agility of movement, or if it will follow the path taken by Western manufacturers, settling into its position and allowing competitors to overtake it, or if it will make mistakes like giving products like the new Roadster, the Tesla Semi, or the Cybertruck priority over other important launches, like its next most affordable model.

Related Post