In a move that’s sending shockwaves through the electric vehicle and renewable energy sectors, Congressional Republicans have just passed what many are calling Trump’s “Big Beautiful Bill” — a sweeping new piece of legislation that’s set to dramatically roll back support for EVs, solar, and clean energy in the U.S.

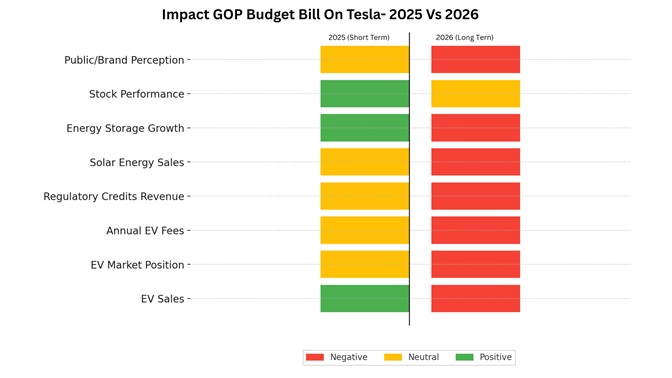

At first glance, Tesla stock price going up might seem like good news — especially compared to sharp drops in other clean energy and EV stocks. But don’t be fooled. This bill could have serious consequences for Tesla and the entire clean tech industry starting in 2026. what’s actually happening and how it could change the future of sustainable transportation and energy in America.

EV Tax Credits Are Getting the Axe

The $7,500 federal tax credit — a major incentive for buying electric vehicles — is being phased out. By the end of 2025, automakers that have sold over 200,000 EVs in the U.S. will lose access to this credit altogether.

Tesla, being one of the first and most successful EV producers, has already blown past that 200,000-vehicle threshold. This means starting in 2026, no more federal tax credit for Tesla buyers — while some newer brands may still qualify. In the short term, Tesla could see a spike in demand as buyers rush to lock in tax credits before they disappear. But come 2026, that demand could fall off a cliff, especially if competitors can still offer those incentives. It’s a looming threat to Tesla’s dominance in the U.S. market.

The bill introduces a $250 annual fee for electric vehicles and $100 for hybrids. Lawmakers claim it’s to make up for lost revenue from gas taxes that fund road maintenance.

This adds an extra cost for every Tesla owner — effectively punishing people who are trying to go green. It’s a subtle but effective way to discourage EV adoption, and Tesla, being the largest EV brand in the U.S., will feel the brunt of it. The added cost could push potential buyers to delay or reconsider switching to electric. Also, some buyers may now associate Tesla more closely with the party responsible for this policy shift — a potential brand image issue, given Elon Musk’s open support of the GOP.

Clean Energy Credits Slashed

The bill wipes out regulatory credits that have supported clean energy companies for years. It even takes aim at California’s Zero-Emission Vehicle (ZEV) mandate, a critical policy that has pushed automakers to build cleaner vehicles.

Tesla has long relied on selling regulatory credits to other automakers as a major source of profit. In Q1 2025, Tesla actually made more from these credits than from selling cars. Without them, Tesla’s bottom line could suffer — possibly turning profits into losses. While it’s unlikely that California’s ZEV program can be easily undone, the removal of federal support is still a blow to Tesla’s financial safety net.

Solar and Energy Storage Incentives Eliminated

Starting January 1, 2026, the 30% Investment Tax Credit (ITC) for solar and energy storage installations will be eliminated. Tesla’s solar division has shrunk in recent years, so this might not seem like a big deal. But its energy storage business is currently one of the few areas seeing growth. Without the ITC, consumer demand for solar and battery products will likely fall, which could undermine one of Tesla’s most promising growth opportunities. In short: this bill kicks Tesla’s energy business when it’s finally starting to gain momentum.

Market Reactions

You might be wondering: if this bill is so bad, why is Tesla’s stock up while rivals like Lucid, Rivian, and SolarEdge are down?

The answer lies in timing. Tesla could see a short-term boost in 2025, as buyers rush to secure their $7,500 tax credit before it disappears. And Tesla investors, ever hopeful about the company’s future potential (especially with full self-driving), may be brushing off the long-term risks for now. But long term? The outlook isn’t pretty.

Once 2026 hits, Tesla — and much of the U.S. EV and clean energy sector — will be navigating a very different landscape, one with fewer incentives, higher costs, and slower adoption.

The bill represents more than just a set of policy changes. It’s a philosophical reversal from investing in a clean energy future to reasserting dominance of fossil fuels and legacy systems. For Tesla, it’s a painful twist: a company that helped spark the EV revolution now faces headwinds largely created by a political shift — one that its own CEO arguably helped bring about. Meanwhile, the U.S., already behind Europe and China in EV adoption, risks falling even further back.

Tesla may get a sugar rush of demand in the next 6–12 months. But beyond that, the future just got a lot tougher. The “Big Beautiful Bill” is anything but beautiful for the EV world — and if we want a cleaner, more sustainable future, this is a step in the wrong direction. Now more than ever, the road ahead for EVs is uphill — and the trailblazer may no longer be the one leading the charge.

Source– Electrek

Related Post