When it comes to electric vehicle (EV) sales in the US, all eyes are usually on Tesla. It’s the biggest EV brand in the country — and often treated like the gold standard. But the headlines you’re seeing right now might not be telling the full story. In fact, Tesla’s US sales performance in early 2025 is looking a lot worse than what’s being reported.

The Headlines Say One Thing… But the Numbers Say Another

A lot of media outlets are currently running with data from Cox Automotive’s Q1 2025 EV sales report. According to them, Tesla sold 128,100 vehicles in the US in the first quarter — a decline of 8.6% compared to Q1 2024.

At first glance, that may not sound too alarming, especially when you consider that overall EV sales in the US actually increased by 10% during the same period. A slight dip for Tesla might seem like a blip on the radar — until you dig a little deeper.

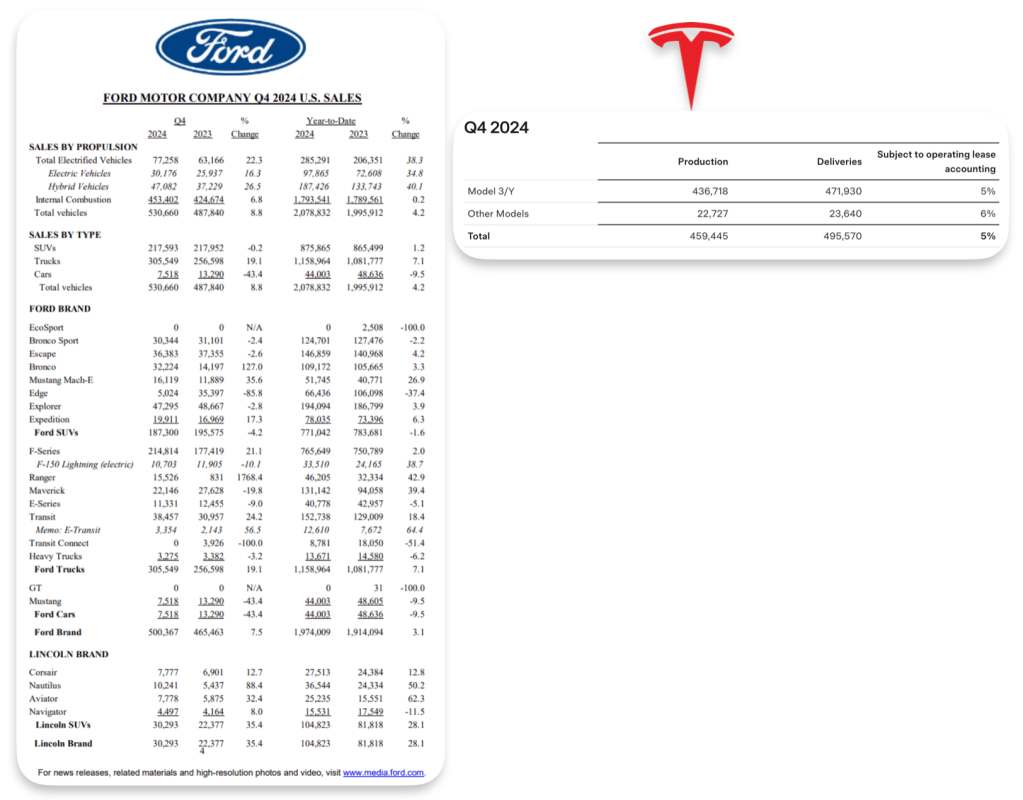

Here’s the problem: Cox’s Tesla numbers are estimates. And they’re based on limited public data, because Tesla doesn’t break down its sales by region or model. Unlike other automakers like Ford, which offer clear US-specific reports, Tesla only releases global delivery numbers. This lack of transparency makes it tricky to know how well Tesla is really doing in the US.

A More Accurate Way to Calculate Tesla’s US Sales

If you want a clearer picture, you need to work backwards from Tesla’s global numbers.

Here’s how:

- Tesla reported 336,681 global deliveries in Q1 2025.

- Thanks to third-party data (like from EV analyst TroyTeslike), we know that registrations in every market outside the US and Canada totaled 212,024 vehicles.

- That means Tesla delivered about 124,657 vehicles in the US and Canada combined.

Now, if we estimate that Canada made up about 5,000 of those vehicles, that leaves roughly 119,600 for the US. Cox overestimated Tesla’s US deliveries by nearly 9,000 vehicles. Instead of being down 8.6%, Tesla’s actual US decline is closer to 15% compared to Q1 2024. That’s a much more dramatic drop — and one that paints a worrying picture.

There are a few possible reasons behind the slump.

- Model Y Transition Issues

Tesla is in the middle of updating its Model Y, and this transition may have slowed down production and deliveries. But that’s only part of the story. - Inventory Is Piling Up

Perhaps more concerning is that Tesla ended Q1 with record-high inventory — the likes of which haven’t been seen in years. That means the company is building cars faster than it’s selling them.

In fact, in many parts of the US, you can walk into a Tesla store and get a new Model Y immediately, with no wait time. That’s unusual for Tesla, which previously had months-long waitlists.

- Fading Demand and Public Perception

There’s another factor that doesn’t show up on spreadsheets: Elon Musk’s growing unpopularity. Throughout the second half of Q1 2025, Musk made several controversial public statements and decisions that likely affected Tesla’s brand image — and that may be turning off potential buyers.

When you combine that with no backlog for its most popular vehicle, it raises a red flag about demand in the US.

It’s not all doom and gloom — at least not yet. There’s a good chance Tesla will deliver more vehicles in Q2 2025 than it did in Q1. However, it’s also very likely that Q2 deliveries will still be lower than in Q2 2024. And if the trend continues, Tesla’s US deliveries could be down for the full year, even though many analysts are still projecting growth. This mismatch between analyst optimism and the ground reality could spell trouble for Tesla’s stock and its image as the EV market leader.

Here’s the report:

| Brand | Q1 2025 Sales | Q1 2024 Sales | YOY % Change |

| Acura | 4,813 | ||

| Audi | 5,905 | 5,714 | 3.3% |

| BMW | 13,538 | 10,712 | 26.4% |

| Cadillac | 7,972 | 5,800 | 37.4% |

| Chevrolet | 19,186 | 8,957 | 114.2% |

| Dodge | 1,947 | ||

| Ford | 22,550 | 20,223 | 11.5% |

| Genesis | 1,496 | 992 | 50.8% |

| GMC | 4,728 | 1,668 | 183.5% |

| Honda | 9,561 | ||

| Hyundai | 12,843 | 12,218 | 5.1% |

| Jaguar | 381 | 256 | 48.8% |

| Jeep | 2,595 | ||

| Kia | 8,656 | 11,401 | -24.1% |

| Lexus | 1,453 | 1,603 | -9.4% |

| Mercedes | 3,472 | 8,336 | -58.3% |

| Mini | 696 | 824 | -15.5% |

| Nissan | 6,471 | 5,284 | 22.5% |

| Porsche | 4,358 | 1,247 | 249.5% |

| Rivian | 8,553 | 13,588 | -37.1% |

| Subaru | 1,154 | 1,147 | 0.6% |

| Tesla | 128,100 | 140,187 | -8.6% |

| Toyota | 5,610 | 1,897 | 195.7% |

| Volvo | 2,718 | 996 | 172.9% |

| VW | 9,564 | 6,167 | 55.1% |

| Additional EV Models | 5,930 | 6,764 | -12.3% |

| Total (Estimates) | 294,250 | 265,981 | 10.6% |

What You Need to Know

✅ Tesla’s Q1 2025 US sales are likely down by ~15%, not the 8.6% reported

✅ Cox Automotive’s numbers are just estimates — and they overestimated

✅ Tesla doesn’t break out regional sales, making true US numbers harder to track

✅ Inventory is at a record high, and demand may be softening

✅ Elon Musk’s controversies could be hurting Tesla’s brand perception

✅ Tesla could still rebound in Q2, but full-year US sales might drop

Tesla isn’t just another car company — it’s a symbol of the EV revolution. But even giants can stumble. While the media might be downplaying how much trouble Tesla is in, the numbers speak for themselves. With falling US demand, rising inventories, and a lack of transparency, Tesla has some big challenges to overcome in 2025.

Whether you’re an investor, a fan, or just someone watching the EV market unfold, one thing’s clear: Tesla’s dominance in the US isn’t as bulletproof as it once seemed. Want more updates on EV trends and behind-the-scenes insights? Stick around — we break down the facts and skip the fluff.

Related Post