The Chinese CATL has begun to beat the price war and reduce costs by 50% this year.

Bringing down the cost of electric cars is one of their biggest obstacles. Even though they have changed for the better, their purchase price remains higher. However, the aggressive movement being readied by the world’s largest battery producer may have its days, not years, numbered. The price war drums have started to be banged by the Chinese CATL.

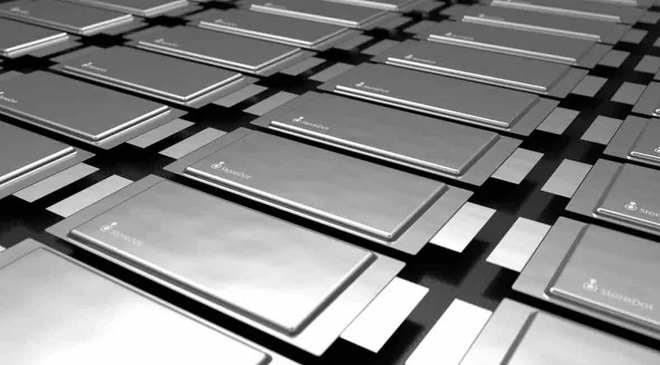

The Asian company has guaranteed a 50% reduction in the price of a kWh this year. A drastic drop that occurs quickly and will hasten the years-long drop in the cost of electric vehicles.

Some of the causes of this include the overproduction that China’s battery industry is going through. Following the pandemic shock, when demand for electric vehicles surged, there was a veritable gold rush for investments in battery plants.

Due to this, manufacturing capacity has increased disproportionately, multiplying its figures between 2022 and 2023 to exceed the industry’s absorption capacity. But, a lot more batteries are produced than are being bought.

A far more straightforward and affordable chemistry that does not require costly elements like nickel or cobalt and has unabatedly advanced energy and volumetric density. In contrast, investments in this kind of battery have benefited from the sharp 77% decrease in lithium costs over the past two years.

Despite this, lithium’s price appears to decline further since data from Reuters indicates that this year, production capacity will surpass demand by 34%. Thus, producers will need to compete for clients.

Battery options multiply

Chinese battery producers ultimately control the market for LFP batteries. They are not alone, though, in placing bets on this chemistry.

Additionally, South Korea’s LG and Japan’s Panasonic are beginning to move. The two titans are starting to produce LFP cells, knowing that the market is moving toward NMCs, even if their wager is nearly entirely on them.

This will contribute to hastening a trend that, research suggests, has seen China’s cell production costs reach 110 euros per kWh by 2023. According to CATL’s estimation, this year’s figure will hover around 40 to 50 euros per kWh.

Something that will inevitably result in a decline in the production costs of electric cars, something that will entail a decrease of more than 50% in only one year and should, therefore, have an effect on the sales pricing of those automobiles.

Related Post