A surge in electric-vehicle sales last month has industry watchers calling it a policy-driven buying spree. New data from Cox Automotive shows U.S. EV purchases jumped sharply in July — and policymakers are getting the credit.

The rush follows a recent federal budget law that eliminated federal EV tax credits for new and used vehicles after September 30. Signed in early July, the move prompted many shoppers to speed up their purchase plans rather than wait and risk losing thousands of dollars in incentives. The result: a near-record month for EV volumes and dwindling inventories at dealerships.

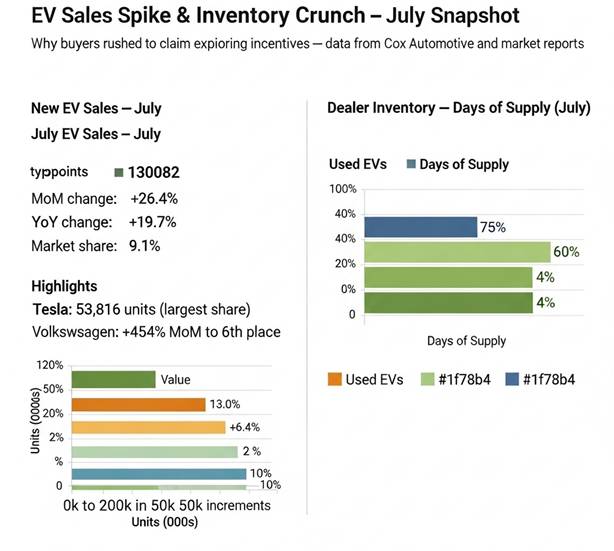

Cox Automotive reported 130,082 new EV sales in July — a 26.4% increase from June and nearly 20% higher than the same month last year. The market share for EVs climbed to 9.1%, a significant number for a market that still runs primarily on gasoline and diesel.

“It was the second-highest monthly total on record, with 11 brands posting their best EV sales of the year,” Cox wrote. Tesla led the pack with 53,816 units, but legacy automakers also showed impressive growth. Chevrolet, Hyundai, Ford and Honda all posted strong gains. Volkswagen leapt into sixth place, surging 454% month over month. Luxury brands were part of the story, too: Audi (+150.2%), Cadillac (+14.5%) and Mercedes-Benz (+6.4%) all reported meaningful increases.

For many buyers, the math is simple. Historically, federal incentives helped knock as much as $7,500 off the price of qualifying new EVs and offered used-EV buyers credits of up to $4,000. With those incentives scheduled to disappear after September 30, consumers figured the financial benefit of buying sooner rather than later outweighs the wait.

Beyond the incentive deadline, dealers and buyers are watching other economic signals. Tariffs, supply-chain uncertainty, and rising costs can all push vehicle prices higher. That “buy now before prices climb” logic appears to be driving real behavior — not just speculation.

“A lot of people simply don’t want to pay more later,” said one dealer contacted in a recent market check. “We’re seeing customers make quicker decisions than they used to.”

Inventory tightens as demand climbs

That buyer urgency shows up in the stock numbers. Used-EV inventories tightened dramatically in July: the average dealer had a 40-day supply of used EVs, down 49% year over year. For context, dealers held roughly a 43-day supply of used internal‑combustion vehicles in July — which means used EVs are now scarcer than gas cars.

New-EV supply is also falling. Cox Automotive estimated an 87-day supply of new EVs compared to a 76-day supply for ICE (internal‑combustion engine) vehicles — but that 87-day number represents a 49% decline in new EV inventory from a year ago. In plain terms, automakers and dealers have fewer new EVs to sell, while buyer demand is heating up.

If you’re in the market for an EV, here’s the practical takeaway: the cost advantage that came from federal credits is scheduled to disappear. For shoppers who were considering a new EV lease or a used EV purchase, the math will change come October 1. Leases that factor in the $7,500 credit will suddenly become more expensive, and buyers of used EVs will lose the $4,000 tax relief that made secondhand electrics more attractive.

That doesn’t mean you should panic-buy — but it does mean being strategic. If you need a vehicle now and an EV checks your boxes (range, charging access, total cost of ownership), exploring current deals and lease specials could be smart. If you can wait, consider shopping around for incentives, dealer discounts, or state and local programs that may still be available.

Market momentum is also influencing personal decisions. Like many Americans watching this unfold, I’ve nudged friends and family to look at EVs sooner rather than later. Several have locked in deals in the last few weeks — whether a used EV with a favorable price or a short-term lease on a new model that drops on incentives.

Still, a word of caution: incentives aren’t the only factor. Consider local charging infrastructure, home charging options, driving range needs, and long‑term maintenance expectations. Buying into the final weeks of a tax break without researching those basics can lead to buyer’s remorse.

This rush underscores how policy can move markets quickly. A change in Washington created a sense of urgency that rippled through dealer lots and consumer inboxes. It also highlights how volatile the EV transition can be: incentives, supply, and consumer confidence all interact in complex ways.

For dealers and automakers, the challenge now is to match inventory with demand while maintaining pricing discipline. For consumers, the key is weighing the immediate financial benefit of incentives against a longer-term ownership picture: how often you drive, where you charge, and what your needs will be down the road.

If you’re considering a used EV or a lease, now is a good time to brush up on the essentials — battery condition, range under real conditions, warranty coverage, and charging options. There may still be bargains to find, but that window is closing fast.

Bottom line: If you’ve been on the fence about an EV and incentives were part of your equation, this month’s market activity is a strong signal that many buyers are answering “yes” now. Whether you follow suit depends on your finances, your driving habits, and how urgently you want to lock in that final piece of federal support before it’s gone.

Related Post