Tesla Surprising Stock Surge: Confidence or Illusion?

Despite Tesla’s recent earnings being the worst in years, its stock jumped a surprising 8%. At first glance, this seems like a paradox — how can a company report financial struggles and still enjoy a stock price boost? The answer lies in Elon Musk, his promises, and the unwavering belief many investors still have in him, even when the facts say otherwise.

In Q1 2025, Tesla reported its weakest financial performance in years. The company is now operating with razor-thin 2% profit margins and would have posted a loss without the sale of regulatory credits. In simpler terms: Tesla is barely making money from selling cars, and it’s using government incentives to stay in the black.

Deliveries also dropped by 50,000 vehicles, but instead of providing clear answers, Musk and the Tesla team blamed it on the Model Y update — while ignoring the huge build-up of unsold inventory. The bigger issue? While the overall electric vehicle (EV) market is growing, Tesla’s sales are shrinking. This points to a Tesla-specific problem, not just a tough economy.

Instead of addressing these core business problems, Elon Musk used the earnings call to pivot the conversation to his favorite topics: humanoid robots and full self-driving (FSD). Musk doubled down on claims that Tesla will produce millions of humanoid robots by the end of the decade and that this alone will make Tesla the most valuable company on Earth. He also promised millions of robotaxis by 2026 and fully unsupervised driving in consumer cars by the end of 2025.

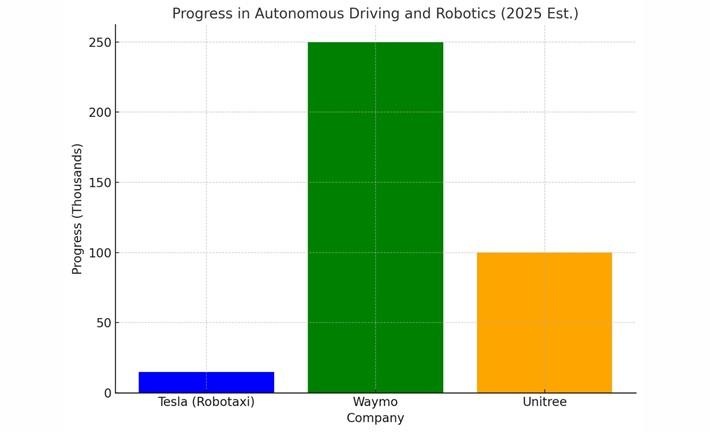

If these promises sound familiar, it’s because they are. Musk has made almost identical statements every year for the past six years — and none of them have materialized. In reality, Tesla has shown no real competitive edge in robotics. The robots it has displayed were controlled by humans behind the scenes, and competitors like Unitree seem to be ahead in this field. On the self-driving front, other companies such as Waymo are already operating hundreds of thousands of driverless rides per week — something Tesla has yet to do at scale.

Tesla plans to launch a small fleet of robotaxis in Austin starting June 2025. This pilot program will include just 10–20 Model Y vehicles operating within a limited, geo-fenced area. Crucially, they’ll also rely on human teleoperators to assist remotely — the same approach Waymo and others have been using for years.

So while Musk will tout this as a major leap forward, it’s essentially a rebranded version of something that already exists elsewhere, and far from the bold promise of fully unsupervised driving in every Tesla since 2016. Meanwhile, buyers who paid thousands for Tesla’s “Full Self-Driving” package are still waiting for the feature to work as advertised. The software has barely improved in recent months because Tesla engineers have shifted focus to support the new Austin fleet. Another delay, another broken promise.

Despite all these red flags, many investors continue to back Musk and his vision. But here’s the catch — it’s less about belief in Tesla’s performance and more about betting on what other investors might do. It’s game theory at this point.

The stock isn’t rising because Tesla is thriving. It’s rising because investors think they can outsmart the next person by buying into the hype and selling at the right time. The actual business fundamentals don’t support the current stock price, which trades at an incredibly high price-to-earnings (P/E) ratio — more in line with booming tech startups than a car company with declining sales.

Musk’s charisma, bold predictions, and sci-fi promises have built a following that borders on cult-like. Critics of Tesla or Musk are often met with personal attacks instead of logical counterarguments. “How many rockets have you landed?” is a common retort, as if questioning Musk’s business choices requires one to be a literal rocket scientist.

Tesla earnings calls now sound like they’re being run by an Elon Musk chatbot. He repeats the same lines about “next year” breakthroughs, deflects criticism with vague excuses, and shifts attention to far-off projects instead of present-day problems. The inclusion of humanoid robots in the conversation feels more like a distraction tactic than a real business strategy.

At this point, Tesla’s stock acts less like a reflection of company performance and more like a confidence meter in Musk himself. Forget the numbers. Forget the missed targets. If investors believe Musk, the stock goes up. If they stop believing, it crashes. It’s that simple.

There’s no doubt that Elon Musk is a visionary. Tesla changed the auto industry and pushed EVs into the mainstream. But being a visionary doesn’t mean you’re always right — or that you can avoid consequences forever.

Tesla is at a critical crossroads. Its core business is stumbling, and promises about the future are beginning to sound like empty slogans. Investors must decide whether to keep betting on bold visions or start demanding real results. Until then, as long as confidence in Musk remains, the stock may stay afloat. But if that confidence cracks — even slightly — it could all come crashing down.

Source- Electrek

Related Post