Coal, long considered one of the dirtiest and most polluting energy sources, might be finding a new lease on life thanks to groundbreaking research by scientists at the Oak Ridge National Laboratory (ORNL). This innovative process transforms coal into graphite, a critical material for (EV) electric vehicle batteries. While this development holds promise for reducing waste and creating sustainable alternatives, it also sparks questions about the long-term implications of coal-based solutions.

Here’s a closer look at how ORNL’s discovery could impact EV battery production, environmental restoration, and the clean energy transition.

Why Graphite Matters in EV Batteries

Graphite is a key component of EV batteries, specifically in the anode, the negatively charged end of the battery. While much of the focus in battery production revolves around materials like lithium and cobalt, graphite is the most abundant material in lithium-ion batteries.

The demand for graphite is soaring as EV adoption accelerates, but the majority of the world’s graphite supply comes from China. While reliance on a single source isn’t inherently problematic, geopolitical tensions could disrupt supply chains and jeopardize domestic EV production.

The Biden administration’s policies have spurred significant investment in EV manufacturing and battery plants across the U.S., emphasizing the importance of onshoring or “friend-shoring” critical materials like graphite. However, the U.S. still faces challenges in securing a stable domestic supply.

Turning Coal into Graphite: ORNL’s Breakthrough

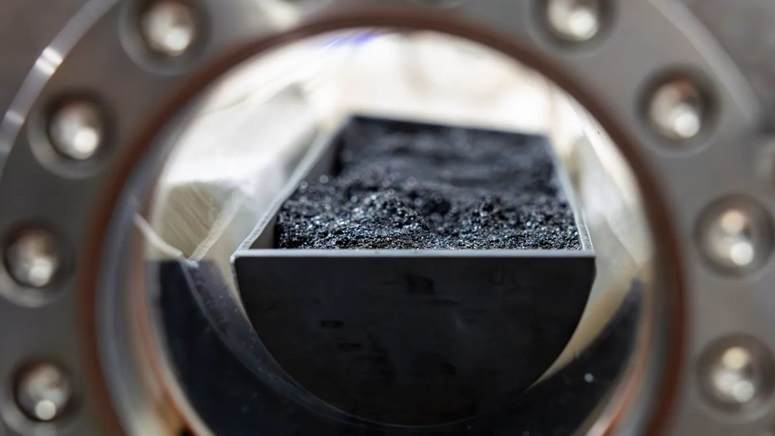

Researchers at ORNL have developed a process to convert coal into high-quality graphite suitable for EV battery anodes. Given that coal is primarily composed of carbon, transforming it into graphite involves removing impurities and refining the material.

Unlike traditional synthetic graphite production, which is costly and energy-intensive, the ORNL process is both faster and more economical. According to Prashant Nagapurkar, an ORNL researcher, this new method is estimated to cost 13% less than the conventional Acheson process. Moreover, if powered by renewable electricity, the entire process can be made environmentally friendly.

A Dual Purpose for Coal Waste

One of the most exciting aspects of this innovation is its potential to repurpose coal waste, such as fly ash—hazardous remnants from past coal mining operations. The U.S. has over 100 million tons of coal waste scattered across the country, posing significant environmental risks.

Using this waste to produce graphite not only addresses a major pollution issue but also provides a sustainable source of material for EV batteries. Researchers estimate that coal waste alone could supply approximately 30% of the graphite needed for EV batteries in the U.S. through 2050.

Analysis by ORNL researcher Prashant Nagapurkar.

In the ORNL process, if the electricity is green, the whole process is green. Especially because coal historically has this reputation as ‘dirty,’ a particularly important next step is to track emissions from the entire supply chain through the manufacturing process. This could demonstrate that it is indeed a greener option to manufacture graphite from coal.

Broader Applications of the Technology

While the current project focuses on coal waste, the electrochemical graphitization process developed by ORNL can be applied to other carbon sources, including biomass (e.g., dead vegetation) and byproducts from petroleum processing.

For example, methane pyrolysis, a process used to produce hydrogen, generates solid carbon as a byproduct. This carbon could also be converted into graphite for battery applications, further diversifying the sources of this critical material.

By expanding the range of carbon inputs, this technology has the potential to strengthen domestic supply chains and reduce reliance on graphite imported from countries with weaker environmental and labor protections.

Environmental and Economic Implications

Environmental Restoration

Repurposing coal waste for graphite production could be a game-changer in environmental restoration. Cleaning up coal mining remnants not only mitigates pollution but also transforms hazardous materials into valuable resources for the clean energy transition.

Economic Benefits

The process also holds promise for creating jobs and driving economic growth in coal-dependent regions. Companies like Ramaco Carbon, which collaborated with ORNL on this project, are focusing on innovative uses for coal beyond combustion. Ramaco’s guiding principle—“coal is too valuable to burn”—reflects a shift toward using coal as a feedstock for materials and chemicals rather than an energy source.

Reducing Carbon Emissions

If implemented correctly, this process could contribute to significant reductions in carbon emissions. Traditional mining and processing of graphite are resource-intensive and often involve environmentally harmful practices. By using coal waste or other carbon sources, the ORNL process offers a cleaner alternative.

Challenges and Concerns

Despite its promise, the concept of turning coal into graphite raises important concerns.

- Encouraging Coal Mining

While the process can utilize coal waste, there’s a risk that companies might prioritize mining new coal if it proves easier or cheaper than processing waste. This could undermine efforts to keep carbon in the ground—a crucial goal in combating climate change. - Potential for Greenwashing

Collaborations with companies like Ramaco Carbon, which still supply coal for steelmaking, may raise red flags. Coal-based steel production is linked to significant health and environmental issues. Without strict oversight, there’s a risk that this technology could be used to justify continued coal extraction. - Carbon Lock-In

The atmospheric carbon concentration has already reached 423 ppm—well above the 280-350 ppm range considered safe for life on Earth. Any process that encourages further extraction of carbon-based materials must be carefully evaluated to ensure it doesn’t exacerbate the climate crisis.

The Path Forward

For this technology to achieve its full potential, it’s essential to strike a balance between innovation and environmental responsibility. Here are some steps that could ensure its success:

- Focus on Waste Utilization

Prioritize the use of coal waste and other byproducts rather than mining new coal. This approach aligns with environmental restoration goals and minimizes the risk of increased carbon emissions. - Monitor Emissions

Track emissions across the entire supply chain to verify the environmental benefits of this process. Transparency will be key in gaining public trust and avoiding accusations of greenwashing. - Expand Applications

Explore alternative carbon sources, such as biomass and methane pyrolysis byproducts, to reduce dependence on coal entirely. - Support Policy and Regulation

Policymakers should establish regulations to ensure that this technology is used responsibly and doesn’t lead to increased coal extraction.

A Step Toward Energy Resilience

In the broader context of the clean energy transition, innovations like ORNL’s graphite production process play a vital role in strengthening energy resilience. A reliable domestic supply of materials like graphite is essential for scaling EV production and reducing reliance on foreign imports.

Additionally, as battery technology evolves, the recyclability of materials like graphite could further enhance sustainability. Unlike fossil fuels, which are burned once and gone forever, graphite can be reused in multiple generations of batteries, contributing to a circular economy.

The Oak Ridge National Laboratory’s breakthrough in turning coal into graphite represents a significant step forward in the quest for sustainable battery materials. By repurposing coal waste and developing a cleaner, more efficient production process, this innovation has the potential to address critical challenges in EV battery manufacturing, environmental restoration, and energy independence.

However, as with any new technology, it’s crucial to remain vigilant and ensure that its implementation aligns with broader environmental and climate goals. While coal may still have a role to play in the clean energy future, that role must be carefully managed to avoid repeating the mistakes of the past.

For homeowners looking to contribute to the clean energy movement, solar power with battery storage is a practical step toward reducing reliance on traditional energy sources. Services like EnergySage can help you find trusted solar installers, making it easier to embrace a greener future.

The road to sustainability is a complex one, but with innovations like ORNL’s graphite production process, we’re taking meaningful strides in the right direction.

Related Post