Ford is betting big on making electric trucks affordable. The company is pitching what it calls a “Model T moment” for the electric-vehicle era — a push to deliver a mainstream, reasonably priced midsize electric pickup that could shake up the U.S. auto market. The headline: a $30,000 midsize electric truck built on a brand-new, highly modular platform and a reworked manufacturing system meant to cut costs and speed production.

Americans love trucks, but affordable electric pickup options have been scarce. Automakers so far have largely rolled out heavy, high-tech EV pickups with massive batteries and jaw-dropping price tags. If Ford can sell a feature-rich midsize electric truck for around $30,000, it would do more than create headlines — it would give everyday buyers a real electric-truck option at a familiar price point.

Ford says the midsize electric truck will be roomy (Ford claims more passenger space than a RAV4), and practical — it will include a frunk as well as a traditional bed. Performance-wise, the automaker promises that the truck will sprint quicker than the Mustang EcoBoost, which does 0-60 in about five seconds. Ford hasn’t released full battery, range, or charging specs yet, but it has announced the truck will use prismatic-format lithium-iron-phosphate (LFP) cells. LFP batteries are generally cheaper and more stable than some alternatives, traits that make them attractive for lower-cost EVs. Ford plans to make these cells domestically, at its BlueOval Battery Park in Michigan, using licensed LFP tech.

A nod to heritage?

Ford hasn’t named the truck yet, but filing activity suggests a possible throwback name — Ranchero — that would tap into a classic Ford identity and could be a marketing win if the product delivers.

The $30K price target positions the truck against budget rivals. One competitor, a bare-bones truck starting in the mid-$20,000s, cuts features to hit its low price — no power windows, no infotainment — which many buyers might find unacceptable. Meanwhile, Ford’s own compact Maverick sits around the same price but in a smaller class. Ford’s promise is a bigger, better-equipped truck at similar money, meaning buyers could get an EV pick-up without sacrificing creature comforts.

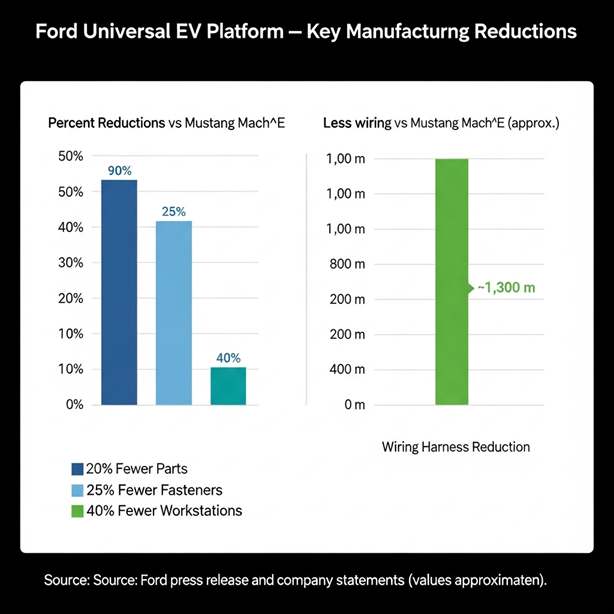

What might be more important than the truck itself is what’s under it. Ford’s Universal EV Platform is a software-first, modular architecture designed to simplify production and slash parts counts. Ford claims the platform will use 20% fewer parts, 25% fewer fasteners, and 40% fewer workstations. The idea is straightforward: fewer parts and simpler assembly mean lower costs and faster build times.

This platform is modular by design. Ford’s illustrations show it spawning a pickup, a small crossover, a cargo van and even a three-row SUV in concept. Ford has canceled and changed plans in the past, but the modular approach gives the company flexibility to build different vehicles on the same underpinnings.

Cutting the wiring

One of the technical changes driving complexity out of EV builds is a zonal electrical architecture. Ford says the Universal platform reduces wiring harness length by roughly 1.3 kilometers compared with its Mustang Mach-E. That’s not just an exercise in neat engineering: wiring is heavy, costly and time-consuming to route. Fewer wires mean less weight, simpler packaging and fewer potential failure points. “Wiring is the nemesis,” Ford’s advanced manufacturing program chief puts it bluntly. EV upstarts such as Tesla and Rivian used similar thinking to cut weight and complexity when designing their newer models.

Ford isn’t stopping at the platform. The automaker plans to transform the factory floor with a production concept it calls an “assembly tree.” Instead of pushing a vehicle down a single, long moving assembly line, Ford breaks the process into sub-assembly streams that run in parallel and then come together. The goal is to cut time on the line, reduce the number of workstations required and speed the path from raw parts to finished vehicle. Ford executives say the approach grew from a small, focused “skunkworks” team that reimagined the moving assembly line to avoid the pitfalls of past attempts at low-cost model launches — like idled plants and layoffs.

There are reasons to be cautious. Hitting a $30,000 price while delivering meaningful range, performance, and features is a tall order. Batteries, raw materials, and factory ramp-up all carry cost risks. Manufacturing changes of this scale bring teething problems and demand flawless execution. Plus, the wider EV ecosystem — public charging availability, parts and dealer readiness — still needs to be friendly to mass-market EV adoption. Ford admits it’s not going to rely on imports for these LFP cells; domestic battery production helps control costs, but it also requires huge investments and flawless scale-up.

If Ford pulls it off, the result could be a genuinely affordable electric truck that redefines expectations and pushes competitors to respond on both price and manufacturing technique. For buyers, the dream is a practical, roomy pickup that’s as accessible as conventional gas trucks — but cleaner, quieter and cheaper to operate. For the industry, the bigger test is whether legacy automakers can match the software-first, simplified manufacturing playbook championed by pure EV pioneers.

Ford is betting that rethinking the way cars are designed and built will open the door to an affordable electric truck for the masses. The plan mixes familiar truck comforts (space, towing, a bed) with industrial and software changes designed to drop costs dramatically. It’s a bold move: if Ford succeeds, it could nudge EV ownership into the mainstream the way the original Model T did for the automobile. If it stumbles, the best-case scenario is a useful lesson in how hard mass-market electrification really is. Either way, truck buyers — and the industry — are about to find out whether a $30,000 electric pickup can be the new normal.

Related Post