What Ev cars qualify to get 7500 $ tax credit in 2022-23

It also gives consumers a tax credit to buy an electric vehicle, or fuel cell vehicle new or used, and a tax credit for up to 7500 $ tax credit in America.

If you’ve been thinking about getting a new electric vehicle, then you probably know that they are more cost-effective to run. You also probably know about the 7500 $ tax credit you get off the price.

There have been big changes to the way it works recently, and people have been uncertain about which cars are eligible, particularly now that a host of new credits have been reintroduced for the US. Customers.

We have a list of the best ten EVs that get the full $7,500 tax credit for 2023. Before we get into the list, it’s required to know some details about how the new system works.

- All electric and plug-in hybrid vehicles that were purchased new in or after 2010 are eligible for a federal income tax credit of up to 7500 $ tax credit.

- You can’t just go out and get an electric car and expect your taxes to be reduced by 7500 $ tax credit in April.

- In reality, your income tax and the size of the electric battery in the car will determine how much you’re eligible for.

There are now many more requirements to be aware of as the result of the recently signed Inflation Reduction Act, such as the requirement that the electric vehicle must be assembled in North America.

If you bought a Ford F 150 Lightning and owed $3,500 in income taxes this year, the federal tax credit you’d get would be $3,500.

Now, if your federal income tax liability was $10,000, you would be entitled to the full 7500 $ tax credit.

Any unused portion of the 7500 $ tax credit cannot be refunded or applied to taxes for the next year.

However, based on the revised tax agreement, you might be able to claim that credit upfront at the point of sale of your EV.

The US. Senate announced before the end of July 2022 that it would soon vote on reforming EV tax credits.

It received Senate approval on August 7, 2022, and President Biden signed it into law a week later. There are many new terms, but we’ll simply touch on the most significant ones.

For starters, the eligibility period for the federal tax credit for electric vehicles has been extended by ten years, from January 2023 to December 2032, and the federal tax credit for EVs will remain at 7500 $ tax credit.

Which electric vehicles could qualify under the latest 7500 $ tax credit?

10 Ev’s That Get FULL 7500 $ tax credit 2022

1- Cadillac Lyriq 2023

Cadillac’s first entry into the luxury electric vehicle market is the Lyric SUV, which features sharp styling and a modern interior and will qualify for the full 7500 $ tax credit.

There will be single-motor, rear-wheel drive, and dual-motor all-wheel drive models available, with the former providing up to 312 miles of range for charging the Lyric was built from the ground up to use General Motor’s new scalable battery architecture, which enables DC fast charging as well as standard in home connections for battery refilling.

- The Lyrics Road manners are more concerned with comfort, quietness, and luxury than with outright performance.

- The cabin is also well-designed and spacious for passengers, but the cargo space isn’t as large as that of rival SUVs.

- The Lyrics base price and attractive $59,990 is for the single motor debut edition model, which comes with limited options.

2- Chevrolet Bolt EUV

This EV has a starting price of $28,195 and qualifies for the full 7500 $ tax credit.

- The 2023 Chevrolet Bolt EUV takes the basic structure of the Bolt EEV hatchback and adds sheet metal to make it look much more like an SUV, which of course, is the body type that American customers enjoy the most.

- Chevy manages to get 247 miles of range out of the EU V 65 kilowatt-hour battery pack.

- The EU V’s 200 HP electric motor only drives the front wheels and passable performance with no claim to any significant offroad ability, putting it on par with many of its competitors.

3- Chevrolet Bolt EV

The Bolt EV costs even lower than the EUV at 26,595 and also qualifies for the full tax credit. Since making its debut in 2016.

- Chevy has developed the Bolt into an interesting compact electric hatchback with an unconventional appearance and a compelling value proposition.

- The Bolt EV is currently the least expensive compact TV available for purchase in the United States, making it a more affordable substitute for models like the Tesla Model Three and Hyundai Kona Electric.

- The Bolt’s front wheels are driven by a single 200 HP motor, which allows it to travel 259 miles on a single charge, according to the EPA.

- Chevy claims that the Bolt’s DC fast charge capabilities can increase the range by up to 100 miles in just 30 minutes. The cabin is also surprisingly spacious and comfortable.

4- Ford’s 2022 F 150 Lightning

The 2022 F 150 also qualifies for the full tax credit, and it costs $53,769. The only thing that’s changed on the F 150 Lightning this year is its price, which has shot up by $12,000 for the entry-level pro model.

- Less drastic but still significant price changes also apply to the higher-end trends. The loaded Platinum now costs $6,000 more, the XLT is up six $500, and the midrange Lariat is up 7500 $ tax credit.

- All these models will get the full tax credit all if 150 Lightning variants come equipped with an all-wheel drive and two electric motors.

- The motor’s combined output is 452 HP with a standard range battery and 580 HP with an extended range battery.

- The maximum torque is an astonishing 775-pound foot. For a truck this massive, the performance is impressive.

5- Ford’s 2022 Mustang mache

Stylish and athletic, the 2022 Ford Mustang mache is an all-electric luxury SUV.

Although mechanically different from the conventional Ford Mustang, it has a lot of design and feels cues from Ford’s Icon.

- It’s not the quickest EV on the market, and some have a longer range, but it offers a terrific balance of speed and range, especially when you include the sumptuous interior and top-notch in-car technology.

- The usable battery capacity of the Maquis has increased marginally for 2022 across most trims. That, in turn, has slightly boosted the Maquis range.

- For instance, the rear-wheel drive California Route One model from the previous year at an EPA estimated range of 305 miles, which is increased to 314 miles for the 2022 model. This vehicle costs $43,895 and qualifies for the full 7500$ tax credit.

6- Nissan Leaf 2022-23

- A starting price below $30,000 for any EV, and this, before any applicable tax credits, is a good thing for 2023.

- Nissan’s electric vehicle gets a new grille, front bumper, and exterior lighting components.

- The outward modifications to the Leaf are completed by a pair of stylish multispoke wheels and an illuminated Nissan envelope.

- Also, the lineup has been trimmed down to just a base S model and the longer-range SV Plus.

7- Rivian R One T 2022

The Rivian R One T is an all-electric pickup truck with a futuristic design that costs $68,575. It has four electric motors, Lightning, quick acceleration, and an estimated range of 314 miles.

- The crew cab only R One T is 215.6 inches long, which places it halfway between full-size trucks like the Ram 500 and mid-size pickup trucks like the Ford Ranger.

- The Ford F 150 Lightning and the GMC Hummer EV Sut are two other electric trucks that have reached production alongside the R One T in what is proving to be a competitive market.

- It’s important to note, however, that only the dual-motor adventure model of the R One T qualifies for the full tax return.

8- Rivian R One S 2022

Rivian’s R One S SUV is the company’s second production model and one of the few three-row EVs available, making it a desirable alternative for families interested in going electric.

- With a base price of $91,000 and greater towing capacity, the R One S directly competes with the Tesla Model X.

- The R One S shares many of the attributes of the R One T pickup, including its 128.9-kilowatt-hour battery pack that the EPA estimates is good for 316 miles of driving per charge.

- The R One S also has a lot of peps thanks to its 835 HP quad motor drivetrain.

- As with the R One T, only the dual motor adventure model of the R One S qualifies for the full tax return.

9- Tesla Model Three 2022

The Tesla Model Three starts at 48,000 440, and it’s worth all the hype it gets.

- Rear-wheel drive has replaced the standard range from last year’s model, which previously used a battery pack made of nickel cobalt aluminum.

- The anticipated range for this entry-level model has risen to 272 miles, despite having a less energy-dense battery pack than the previous one.

- This year, the anticipated driving range of the long-range trim has slightly increased to 358 miles per charge,

10- Tesla Model Y 2022

This one costs $65,990 and is also excellent for 2022. The entry-level standard range model will no longer be offered, making the long-range the de facto basic model.

- This year, the long range’s estimated driving range increased to 330 miles when fitted with the standard 19-inch wheel.

- Picking the more attractive 20-inch tires claims to reduce the range to only 318 miles per charge.

- When it comes to buying an electric car, the range is everything, and the long-range and performance models have 300 and 303 miles of range, respectively.

So you have ten vehicles that will net you a nice tax credit.

The federal government has been telling Americans that they can earn 7500 $ tax credit if they buy a new electric vehicle.

The deal comes from the recently enacted Inflation Reduction Act, which the legislation generated a tax credit for any American who wants to buy a new electric car.

It’s important to know the facts on EV tax credits and that many vehicles will not be eligible.

FAQ/Frequently Asked Questions

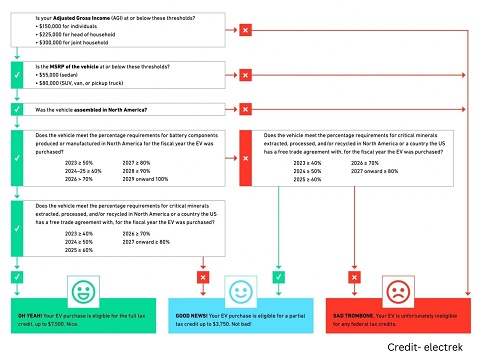

Q.1 What requirements need to get a full 7500 $ tax credit?

Consumers need to meet the requirement to earn the tax credit. And the restrictions are significant, with the new credit making it much harder to gain the full amount.

let me give you an example. A taxpayer looking to claim the credit of 7500 $ tax credit has filed their tax return and owes $4,000 on that tax bill.

- The full tax credit won’t be available under the EV tax deal, that taxpayer could only earn $4,000 because that’s what they owe. Uncle Sam means that they now owe zero.

- The remaining $3,500 could not be claimed based on tax credit legislation for future years. So you got to use it in the year you buy the car.

So if you owe more than 7500 $ tax credit on your federal taxes only federal, not state you’re in luck.

Q.2. is the leased vehicle eligible for 7500$ tax credit?

A new EV owner is not eligible for the tax credit on a least qualified vehicle. In this scenario, the manufacturer owns the vehicle and not you, thus eliminating the tax credit to you.

That is frustrating, as it is misleading to the buyer who wants to lease. Some people do.

There is also a price limit on eligible vehicles and an income cap determining who can claim that tax credit.

Q.3- What income cap is required for 7500$ tax credit?

The income ceiling is capped at $150,000. For joint filers or surviving spouses. It’s limited to $300,000 and for household heads.

That ceiling is limited to $225,000. Add these additional EV tax restrictions to the list and the price limits, and many cars and buyers are eliminated.

Q.4. What is the price cap on Evs to get 7500 $ tax credit?

New cars are capped at $55,000 and $80,000. For SUVs and trucks, vans are not eligible. Now. Maybe you’d consider a used electric vehicle.

Q.5. Is Used Evs have limits for a tax credit?

There are limits there as well. In the case of a used vehicle that qualifies for the tax credit, the cost of the vehicle must be less than $25,000 and it should be at least two years old.

Q.6 What are the new Rules for tax credit 2023?

The huge factor for 2022 is the electric vehicle must be made in the US. And must be assembled in North America to be qualified.

The rules change for 2023, where the battery and its materials must come from North America, and this limits you and your options as well.

There is a handful that will be eligible for the discount. The 7500 $ tax credit was easier to earn before the Inflation Reduction Act, as the new rules have reduced the number of electric vehicles that are eligible for the tax credit.

Q.7. What is the Path for Ev tax credit?

The path to an EV tax credit does exist as long as drivers abide by the Inflation Reduction Act rule.

I suggest you get the paperwork for the claim from the purchase of the new or used electric vehicle, then submit that paperwork with your tax return at the end of the year.

Related Post