The electric vehicle (EV) race is heating up fast—especially in China, the world’s most competitive EV market. And now, after a tough year, Volkswagen (VW) is charging back with a bold new strategy: embrace artificial intelligence (AI), partner with local tech giants, and make smarter, more affordable EVs that can drive themselves. If VW pulls this off, it could completely reshape how foreign automakers compete in China—and maybe even globally.

In 2024, VW took a hard hit in China. Sales dropped by nearly 10% as local giants like BYD and Geely flooded the streets with affordable, high-quality electric cars packed with smart tech. For a company that once ruled the Chinese auto market, this was a loud and clear signal: evolve, or get left behind.

Now VW is plotting a major comeback, and at the heart of that plan is a brand-new AI-powered driver assistance system, launching later this year. This is not just about playing catch-up—it’s about leaping forward into the future of autonomous driving.

To pull off this ambitious vision, Volkswagen partnered with Chinese tech leader Horizon Robotics to form a joint venture called Carizon. Over the past 18 months, about 500 engineers in Shanghai and Beijing have been working around the clock to develop an advanced driver-assistance platform.

This new system will debut in a yet-to-be-named EV later this year and is designed to enable “Level 2++” autonomous driving. What does that mean? Think of it as smarter than current ADAS (like lane-keeping and adaptive cruise control) but not quite fully self-driving. It’s a crucial step on the road to full autonomy (Level 3 and above).

The platform can process 2 terabytes of data per vehicle per day and record driving data from up to 100,000 kilometers daily—which helps fine-tune the AI to drive more like a human.

VW’s Affordable Self-Driving Vision

Here’s what makes this initiative different: Volkswagen isn’t just saving this tech for its most expensive cars. Instead, the company plans to integrate it into its China-specific Compact Main Platform (CMP), meaning more affordable EVs can benefit too.

That’s a big deal. While companies like Tesla and Waymo focus on premium self-driving experiences, VW wants to bring advanced AI driving to the masses. In a country like China—where autonomous tech is developing at lightning speed—this could be a game-changer.

It’s no coincidence that VW is focusing its autonomous ambitions in China. As of early 2025, at least 19 Chinese cities have allowed public road testing for driverless vehicles—more than any other country. Tech firms like Baidu, WeRide, and EV manufacturers like BYD are leading the charge.

While U.S. progress on autonomous driving has slowed due to regulations and safety concerns, China’s rapid innovation makes it the ideal testing ground for future mobility.

But there’s also a growing concern in China over how ADAS features are marketed. Some companies have blurred the lines between “driver assistance” and “full autonomy.” In response, Chinese regulators are starting to crack down, ensuring that marketing claims don’t oversell the technology.

Meanwhile, over in Japan, three auto titans—Toyota, Nissan, and Honda—are teaming up to tackle a different piece of the puzzle: semiconductors.

They’ve formed a consortium called ASRA to design standardized chips for future cars. These chips are essential for autonomous driving, software-defined vehicles, and AI-based features. Japan knows it’s behind in this area—and it’s fighting back with innovation and collaboration.

With $286 million in government backing, ASRA plans to create modular “chiplets” that can scale based on a vehicle’s capabilities. A basic car may need only one chip, while a fully autonomous EV might need several plus an AI processor. First prototypes are expected by 2029. This partnership is a direct response to China’s dominance in automotive tech and could help Japan remain competitive in the global EV race.

Quality Over Quantity

While Japanese and Western automakers like Toyota and VW hold more EV patents, Chinese firms are starting to lead where it matters: quality and impact.

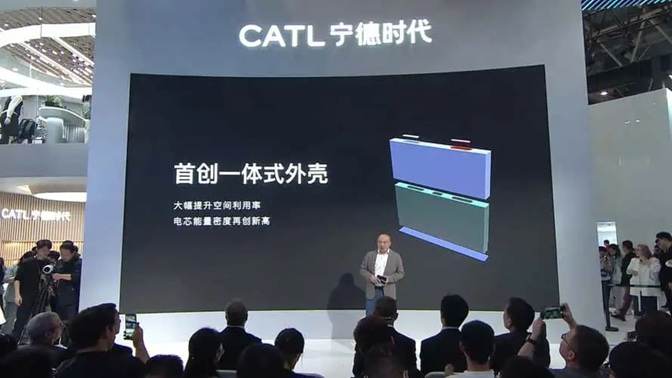

According to a recent report, companies like CATL, Huawei, and BYD rank highest when patents are judged by influence, usefulness, and citations. CATL—the world’s largest EV battery maker—topped the list, beating out even South Korea’s LG Energy Solution and the legacy automakers. This shows that while China may have fewer patents overall, the ones it holds are pushing the industry forward.

There’s another interesting angle here. As the U.S. ramps up tariffs on Chinese goods, companies like CATL are finding smart workarounds. They’ve licensed their battery technology to Ford and are in talks with GM to do the same.

This means American automakers can build Chinese tech in the U.S., avoiding tariffs while giving CATL royalty payments. It’s a win-win—for now.

But the bigger question is: how long can American companies rely on Chinese innovation while trying to block Chinese products? This tension will define much of the global EV strategy in the years ahead.

Volkswagen’s comeback in China, Japan’s chip strategy, and China’s patent dominance all point to one thing: the EV race is no longer just about building electric cars. It’s about building smarter, more connected, and AI-driven vehicles. Autonomy, data, and global cooperation (or competition) will define the next chapter of mobility. The winners? The companies—and the countries—that adapt the fastest.

Related Post