The long-anticipated 25% tariffs imposed by President Donald Trump on imports from Canada and Mexico have officially taken effect. This move is expected to significantly increase car prices for American consumers, particularly for vehicles manufactured in these neighboring countries. In some cases, electric vehicles (EVs) could see price hikes of over $12,000, making them even less accessible to the average buyer.

If you’ve been in the market for a new car, brace yourself—prices are about to skyrocket. Over the past five years, car prices have already surged by 20%, and these tariffs will push them even higher. According to Patrick Anderson, CEO of Anderson Economic Group, the direct impact of these tariffs will be an almost immediate decline in sales for models most affected by the new trade barriers.

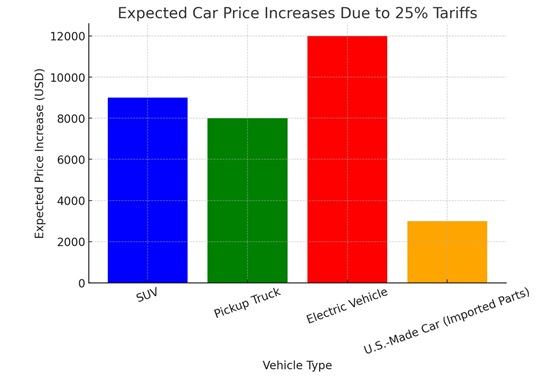

For instance, large SUVs made in North America will likely see price increases of around $9,000, while pickup trucks could rise by $8,000. Automakers and dealerships may even phase out some models entirely if they become too expensive to sell profitably in the U.S.

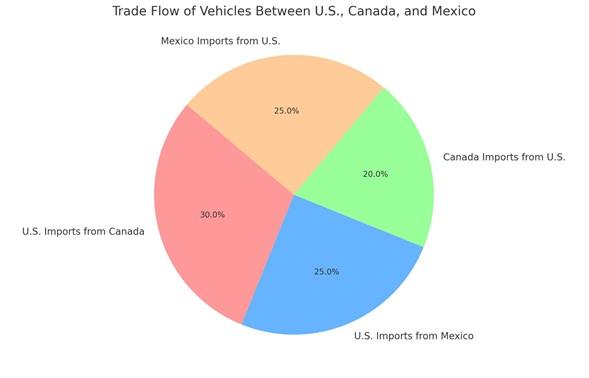

This isn’t just bad news for foreign brands—American automakers like Ford, General Motors (GM), and Stellantis (which owns Chrysler, Dodge, and Jeep) are also taking a hit. Many of their popular models, including the Ford Maverick pickup, Bronco Sport, and Mustang Mach-E, are built in Mexico. GM’s Chevrolet Blazer EV and Equinox EV, which are also made in Mexico, will be affected as well. With roughly one-quarter of all vehicles sold in the U.S. coming from Mexico and Canada, these tariffs will disrupt the entire industry.

Impact on U.S.-Manufactured Vehicles

Even cars assembled within the U.S. won’t escape these cost hikes. Many American-made vehicles rely on parts imported from Canada and Mexico. According to The Wall Street Journal, this could add an extra $3,000 to the cost of a U.S.-assembled car.

Tesla, for example, sources around 20% of its parts from Mexico, meaning the tariffs will increase production costs for its American-built EVs. While consumers won’t feel the effects immediately—since dealerships still have pre-tariff inventory in stock—once those cars are sold, the cost of restocking new vehicles will jump, and much of that increase will be passed down to buyers.

Many experts believe these tariffs are the beginning of a full-blown trade war between the U.S., Canada, and Mexico. Ironically, this move violates the very United States-Mexico-Canada Agreement (USMCA) that Trump negotiated during his first term. That trade deal encouraged American automakers to expand manufacturing in Canada and Mexico, integrating their supply chains across borders.

Now, with these tariffs in place, that $2.2 trillion annual trade relationship between the U.S. and its neighbors is at risk. While the immediate impact may not be obvious, anyone considering buying a new car soon should act quickly before price hikes fully take effect.

The Trump administration argues that the tariffs will encourage Americans to buy vehicles built entirely in the U.S., using only U.S.-sourced parts. However, many economists are skeptical. In reality, this policy could drive more people toward the used car market or increase imports of second-hand vehicles from other countries.

Even Trump himself admitted that American consumers would experience “some pain” due to the tariffs. However, he justified the decision by claiming it would help restore American economic strength. According to a Yale University Budget Lab study quoted by MarketWatch, these tariffs could cost the average American about $1,250 in lost purchasing power annually—money that could otherwise be spent on necessities like groceries, rent, or savings.

One of the biggest concerns is job losses. If automakers find it too expensive to continue producing vehicles in Canada and Mexico, they might shut down factories in those countries. This could put thousands of workers out of jobs and force Canada and Mexico to retaliate with their own tariffs, further escalating tensions.

While Trump’s goal is to bring manufacturing jobs back to the U.S., the reality is that building new car plants takes years, and there’s no guarantee automakers will invest in domestic facilities when production costs are already high. Instead of boosting American jobs, the tariffs could lead to higher car prices, factory closures, and strained trade relations.

Who Will Be Hit the Hardest?

The people most affected by these tariffs will be middle-class and lower-income Americans, who already struggle with the high cost of living. Those who rely on affordable vehicles for work, commuting, and family transportation will find fewer options within their budget. Additionally, small businesses that depend on pickup trucks and work vehicles will have to pay significantly more, potentially leading to higher costs for services and goods across various industries.

The new 25% tariffs on Canadian and Mexican car imports are poised to shake up the U.S. auto industry, driving up vehicle prices, disrupting supply chains, and possibly sparking a broader trade war. While the Trump administration hopes to boost domestic manufacturing, the reality is that the short-term effects will likely hurt consumers and automakers alike.

If you’re planning to buy a new car soon, now might be the best time to do so before dealerships start marking up prices to offset these tariffs. And if you’re in the market for a used car, be prepared—demand for second-hand vehicles is expected to soar as new car prices climb.

At the end of the day, whether these tariffs achieve their intended goals or backfire remains to be seen. One thing is certain: American car buyers will be footing the bill in the meantime.

Related Post