Tesla Sales Slow, But U.S. EV Market Hits Record Highs:

The U.S. electric vehicle (EV) market is set to experience a record-breaking quarter, with nearly 340,000 EVs expected to be sold in Q3 2024. This growth is impressive, but it comes amid surprising news: Tesla, the long-standing leader in the EV market, is witnessing a slowdown in sales. Despite Tesla’s slump, the overall market continues to expand, driven by increasing demand for electric vehicles and growing competition from other automakers.

Let’s dive into the key trends, Tesla’s challenges, and what this means for the EV industry moving forward.

U.S. EV Sales Set to Break Records

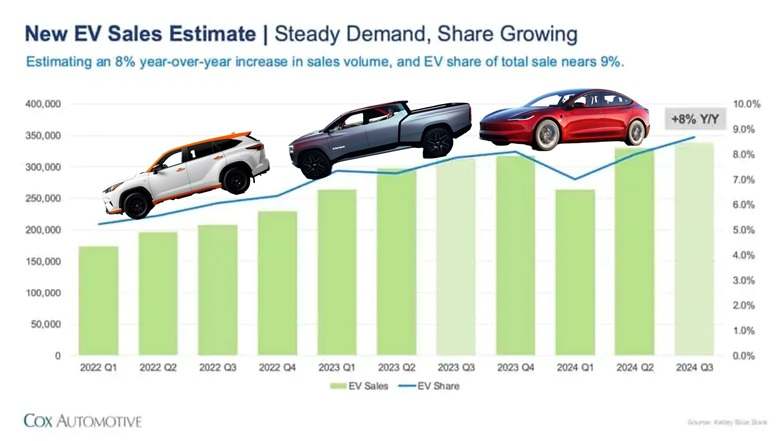

According to recent forecasts from Cox Automotive, around 338,844 new EVs will be sold in the third quarter of 2024. This marks an 8% increase compared to the same period last year, and EVs are expected to account for 9% of the total U.S. car market. This steady growth indicates that while the overall pace of EV adoption may have slowed, the market is still on a solid upward trajectory.

Key Point: Despite some slowing momentum, U.S. EV sales are still growing, and the market is set for a record quarter.

Tesla’s Sales Decline: What’s Happening?

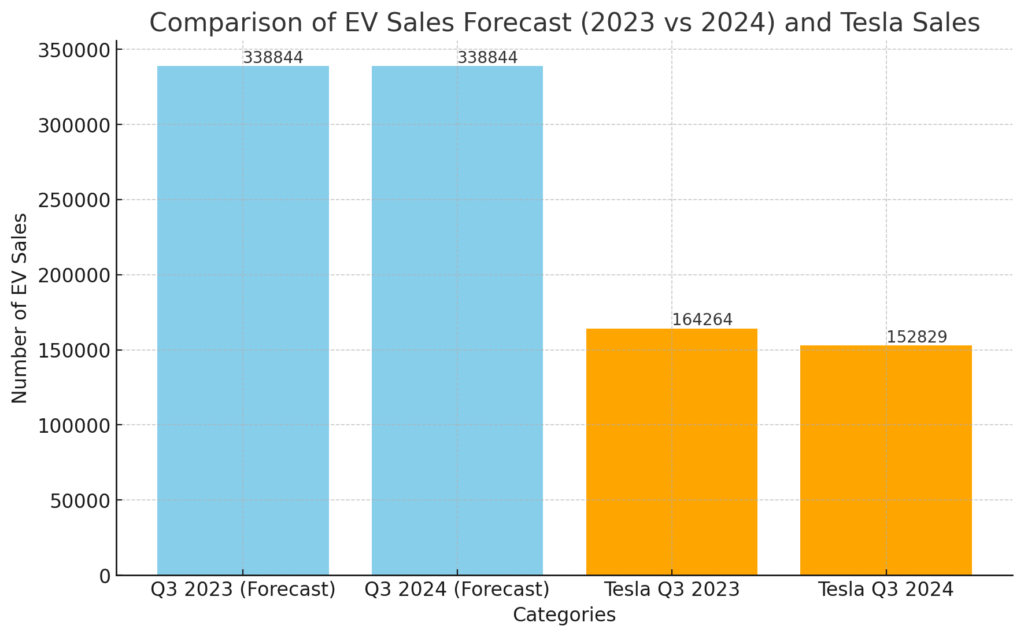

While the overall EV market is thriving, Tesla’s sales have been sinking. Cox Automotive projects that Tesla’s U.S. sales will fall by 7% quarter-over-quarter in Q3 2024, marking the third consecutive quarter of decline for the automaker. Tesla’s estimated Q3 sales stand at 152,829 units, down from 164,264 in the previous quarter.

This slowdown is largely due to a drop in sales of Tesla’s Model 3 and Model Y, which have been the company’s biggest money-makers. Though Cybertruck sales have shown promise, they haven’t been enough to offset the decline in Tesla’s more popular models.

Tesla vs. Other EV Manufacturers (Q3 2024 Forecast)

| Manufacturer | Q3 2024 Sales Forecast | Q2 2024 Sales | Change |

|---|---|---|---|

| Tesla | 152,829 | 164,264 | -7% |

| General Motors | Increasing | Rising | Positive |

| Kia | Increasing | Rising | Positive |

Tesla’s market share is also slipping. At the end of Q2 2024, Tesla’s share of EV sales dropped below 50%, settling at 44% by August. This marks a significant decline from previous years when Tesla dominated the market with ease.

What’s Behind Tesla’s Sales Slump?

Several factors have contributed to Tesla’s recent struggles, despite being the leading EV manufacturer in the U.S. market.

1. Stale Product Lineup

Tesla’s top-selling Model Y has not received any major updates since its launch in 2020. While Tesla did make some minor tweaks to the Model 3, these changes were limited and have not significantly boosted sales. As a result, Tesla’s lineup has begun to feel outdated compared to the newer and more innovative models from competitors.

2. Increasing Competition

Tesla is no longer the only game in town. General Motors, Kia, and other automakers are rapidly increasing their share of the EV market. As competition intensifies, consumers now have more choices, often at more competitive price points and with features that Tesla vehicles lack.

3. Price Sensitivity

The average price of an EV remains a major hurdle for many potential buyers. In August 2024, the average EV sold for $56,574, which is significantly higher than the average price of traditional combustion vehicles. Tesla has traditionally sold its vehicles at the higher end of the price spectrum, making it more vulnerable to price-conscious consumers looking for more affordable alternatives.

Here is a bar graph that compares the EV sales forecast for Q3 2023 and Q3 2024, along with Tesla’s sales for the same periods. It illustrates the overall growth in EV sales and the decline in Tesla’s performance between Q3 2023 and Q3 2024. The forecast shows stable growth in the EV market, while Tesla faces a slight dip in sales.

Bright Spots in the EV Market

Despite Tesla’s slowdown, several factors are driving overall EV growth in the U.S.

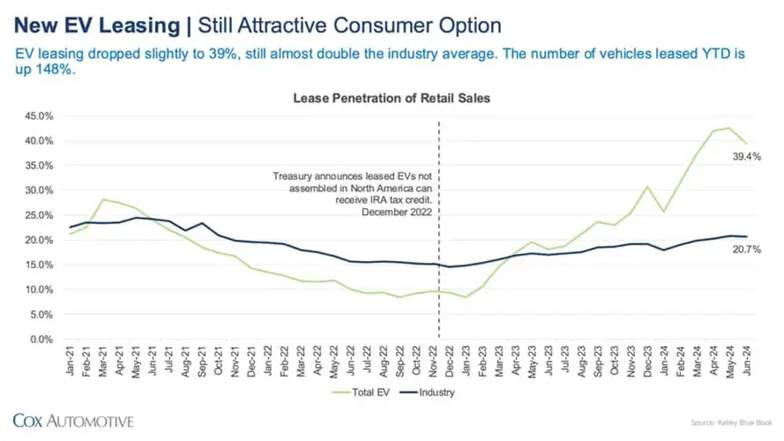

1. Incentives and Leasing

One of the biggest boosts to EV sales this year has been incentives. In August 2024, incentives on EVs hit 13.3% of their average transaction price, which is 80% higher than incentives on traditional vehicles. Additionally, a loophole in the federal tax credit system allows EVs to qualify for the $7,500 tax credit if they are leased, even if they don’t meet the stricter requirements for purchased vehicles. This has led to a surge in EV leasing, which has jumped by 148% year-over-year.

Key Point: Generous incentives and tax credits are helping to make EVs more affordable, especially through leasing options.

2. Used EV Market

Another growing segment is the used EV market. While still relatively small, it’s expanding rapidly. Cox Automotive projects that around 78,000 used EVs will be sold in Q3 2024, representing a 69% increase compared to Q3 2023. Notably, used Tesla Model 3 and Model Y prices have dropped significantly, making them more attractive to buyers.

The Road Ahead for Tesla and the EV Market

Tesla’s challenges are part of the growing pains that come with an industry in transition. The company has relied heavily on just two models, the Model 3 and Model Y, and the lack of significant updates to these vehicles is starting to show. With competition from other automakers increasing, Tesla will need to innovate and expand its lineup to maintain its dominant position in the market.

Will Tesla Bounce Back?

Tesla’s CEO, Elon Musk, has hinted at new models, including more affordable options, but details remain scarce. As the company faces an uncertain economic climate and more aggressive competition, all eyes are on whether it can regain its footing and close out the year with growth.

The Future of EVs in the U.S.

Despite Tesla’s current struggles, the U.S. EV market is continuing to grow, and 2024 is shaping up to be a record year for electric vehicle sales. As more automakers introduce affordable, innovative, and feature-packed EVs, consumers are gaining more choices, which could lead to even faster adoption in the years to come.

Key Factors Driving EV Growth

| Factor | Impact |

|---|---|

| Incentives and Tax Credits | Reducing the overall cost of EVs, especially for leases. |

| Increased Competition | More choices and innovations for consumers. |

| Used EV Market Growth | Making EVs more accessible to a wider audience. |

Key Point: With more competition, better incentives, and a growing used market, EV adoption will continue to rise, even as Tesla faces challenges.

In conclusion, the U.S. EV market is on track for a record-breaking year, despite Tesla’s slowing growth. With increasing competition and attractive incentives, the future looks bright for EVs. Tesla, as the leading EV manufacturer, will need to innovate and adapt to stay ahead, but the industry as a whole is charging toward a more electric future.

Related Post