Germany’s car market might be going through a rough patch, but you wouldn’t know it if you looked at electric vehicle (EV) sales. Despite the overall auto industry struggling to find its footing in 2024, EVs are charging ahead—literally.

According to a recent report from Spanish outlet Motorpasión, Germany’s auto authority (KBA, similar to the U.S. NHTSA) confirmed that electric vehicles now make up around 17% of all new car registrations in the country. That’s a huge jump—more than 35% growth year over year—and it’s happening without any help from government subsidies.

Until the end of 2023, Germany had a fairly generous EV subsidy program. Buyers of electric cars priced under €40,000 could get a €4,500 incentive. Those buying EVs between €40,000 and €65,000 were eligible for a €3,000 subsidy. But that program ended—first for businesses in September 2023, then for private buyers in December.

Logically, you’d expect EV sales to crash after that. And for a moment, they did dip—especially in early 2024. But that was more of a market correction than a crash. In reality, many buyers rushed to place orders in late 2023 to take advantage of the subsidy before it disappeared. That spike in late-year demand temporarily inflated 2023 sales and made 2024’s numbers look weak by comparison.

But here’s the kicker: even without financial support, EV sales continue to grow. Why? Because buyers in Germany are making the shift to electric for other reasons—environmental awareness, lower running costs, and a growing variety of high-quality EV options.

🇩🇪 Germany Buys Differently

One thing to remember: in Europe, car buying works a little differently than in places like the U.S. Instead of walking into a dealership and driving out the same day, European buyers often custom order their vehicles. They visit a showroom, choose their features, finalize their build, and then wait 3 to 4 months for delivery. This makes the market less volatile and more predictable over time.

It also means that “pull-ahead” sales—where people rushed to buy before the subsidies ended—can influence data several months into the next year. So while EV sales dipped at first, the underlying demand is clearly still strong.

Now, while EV sales are booming overall, one brand is noticeably struggling: Tesla. Once seen as the gold standard in electric cars, Tesla is now facing serious headwinds in Germany. In fact, the numbers are brutal: Tesla sales in Germany dropped by 70% year over year in the first two months of 2024. Even more surprising, a reported 94% of surveyed buyers said they wouldn’t consider buying a Tesla.

There are two key reasons behind Tesla’s decline:

1. The End of Subsidies Hit Tesla the Hardest

Tesla’s Model 3 and Model Y were among the most popular EVs in Germany during the subsidy era. Once those incentives disappeared, many buyers who were borderline on price jumped ship to more affordable or better-equipped European options.

And with no discounts, no price flexibility, and a growing field of competitors offering more localized service and dealership networks, Tesla’s one-price online model isn’t as appealing to German buyers.

2. Elon Musk’s Politics Are Hurting the Brand

Like it or not, Tesla has become increasingly tied to Elon Musk’s public persona—and not in a good way. His political leanings, controversial public statements, and high-profile support of far-right figures have alienated many European consumers, especially in socially progressive markets like Germany.

In short, for many buyers, Tesla has become too politically charged. The result? People are trading in their Teslas early and moving to brands that feel more neutral—and frankly, more European.

So What EVs Are Germans Buying?

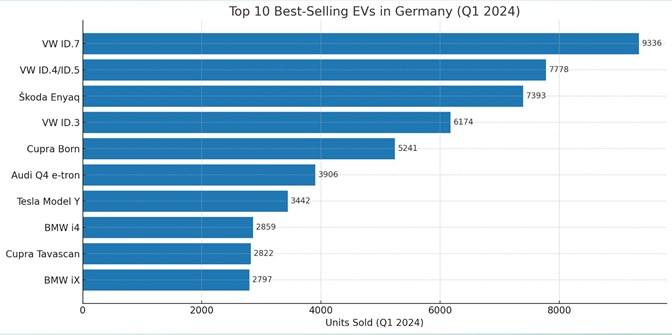

Here’s a look at the top 10 best-selling electric vehicles in Germany so far in 2024. It paints a clear picture of shifting tastes:

| Rank | Model | Units Sold |

|---|---|---|

| 1 | Volkswagen ID.7 | 9,336 |

| 2 | Volkswagen ID.4 / ID.5 | 7,778 |

| 3 | Škoda Enyaq | 7,393 |

| 4 | Volkswagen ID.3 | 6,174 |

| 5 | Cupra Born | 5,241 |

| 6 | Audi Q4 e-tron | 3,906 |

| 7 | Tesla Model Y | 3,442 |

| 8 | BMW i4 | 2,859 |

| 9 | Cupra Tavascan | 2,822 |

| 10 | BMW iX | 2,797 |

Notice a trend? German and European brands dominate the list, offering a mix of familiar names, innovative design, and strong local support. Tesla’s Model Y, which once topped global sales charts, is now struggling to hold onto a top 10 spot.

The data sends a clear message: Germany is still all in on electric vehicles, even without subsidies. That’s a big sign of long-term stability and genuine market interest. As for Tesla, the brand’s future in Europe might depend less on technology and more on public relations. With high-quality European EVs coming fast and strong, buyers no longer have to compromise to go electric. Whether you’re in Berlin or Boston, this shift in Germany could hint at what’s coming next worldwide: a maturing EV market where quality, brand perception, and local preferences matter more than hype.

Related Post