Tesla is starting 2025 on shaky ground, with sales plummeting in several key markets. Australia is the latest country to report a significant drop, and this time, the automaker can’t point fingers at its usual excuse—the Model Y production transition.

Earlier this week, reports from Europe revealed a massive drop in Tesla sales, with numbers slashed in half compared to January 2024. Now, Australia’s figures tell a similar story, confirming that Tesla’s struggles extend beyond a single region. The question is: What’s causing this decline?

Tesla’s Struggles

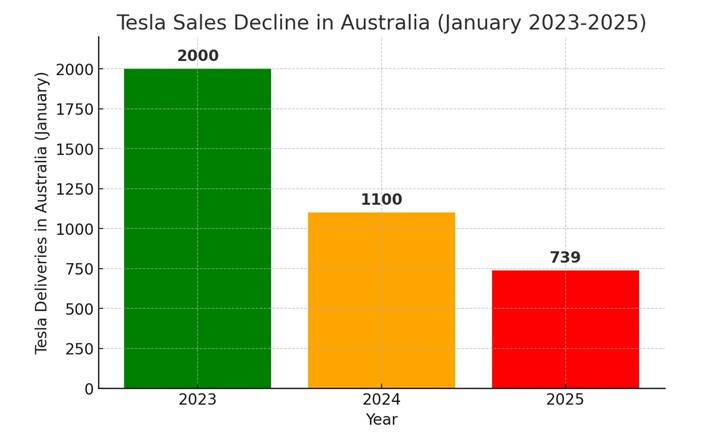

In January 2025, Tesla managed to deliver only 739 vehicles in Australia—a staggering 33% drop compared to January 2024. While this may not seem like a huge deal at first glance, it’s part of a larger downward trend for the automaker.

To put things into perspective:

- Tesla delivered over 2,000 vehicles in Australia back in January 2023.

- By 2024, that number had already shrunk significantly.

- Now in 2025, it has plunged even further, with deliveries barely breaking 700.

This isn’t just a bad month—it’s a clear pattern of decline that’s been developing for the past two years.

The Model Y Is Thriving

Here’s where things get interesting. While Tesla has previously blamed sales slumps on the Model Y production transition, that excuse doesn’t hold up in Australia.

- Model Y deliveries actually increased by 20% in January.

- The real problem? Model 3 sales collapsed by 63%.

The Model 3, Tesla’s most affordable and widely accessible vehicle, has traditionally been its best-seller in many markets. But now, demand is drying up fast, especially in places like Australia and Europe. If Tesla’s most budget-friendly car is struggling, that’s a major red flag. It suggests that buyers are losing interest in the brand itself—not just in one particular model.

Two Key Reasons Tesla Losing Sales

Most industry analysts believe there are two main factors behind Tesla’s sales slump:

1. Tesla’s PR Problem

There’s no denying that Elon Musk’s influence on Tesla is both a blessing and a curse. While his vision and leadership built Tesla into an EV powerhouse, his recent social media behavior and political comments have been turning customers away.

Many consumers feel alienated by Musk’s controversial statements, and it’s having a real impact on Tesla’s brand image. Unlike traditional automakers, Tesla’s identity is closely tied to its CEO, meaning Musk’s personal opinions can directly affect sales. This backlash isn’t just speculation—it’s showing up in Tesla’s shrinking market share across multiple regions.

2. The Model Y Changeover & Production Delays

To be fair, Tesla’s transition to the new Model Y design has played a role in slowing down deliveries. With production adjustments underway, some buyers have been waiting longer than expected for their orders.

But here’s the catch:

- This excuse only applies to Model Y sales.

- Model Y deliveries actually increased in Australia—so it’s not the reason for Tesla’s struggles there.

- The Model 3 is struggling, and that’s a separate issue altogether.

So, while production challenges may have contributed to the problem, they don’t fully explain Tesla’s broader sales decline.

Is Tesla Losing Its Edge?

Australia isn’t an enormous car market, so a drop in sales there won’t make or break Tesla. However, when you compare this trend to other regions, the picture becomes more concerning.

- In Europe, Tesla sales in January 2025 were down nearly 50% compared to January 2024.

- In China, local EV brands like BYD are eating into Tesla’s market share.

- Even in the U.S., Tesla faces increased competition from legacy automakers like Ford, GM, and Hyundai, who are ramping up their EV offerings.

The biggest wild card is the U.S. market, where Elon Musk still has a strong fanbase. However, since U.S. car sales data isn’t as transparent, it might take a while to see the full impact of these trends.

With Q1 of 2025 shaping up to be one of Tesla’s weakest quarters in years, the automaker needs to act fast.

Here are a few potential ways Tesla could turn things around:

- Aggressive pricing strategies: Tesla has already started slashing prices in some regions, but will it be enough?

- Stronger marketing and PR management: With Musk’s controversial statements affecting sales, Tesla might need to refocus its brand messaging.

- Expanding its model lineup: While Tesla is working on the Cybertruck and the long-awaited “affordable” EV, it may need to accelerate these launches.

- Better customer engagement: Many buyers have complained about Tesla’s customer service. Improving after-sales support could help regain trust.

At this point, Tesla isn’t in trouble yet, but if these sales trends continue, it could face serious competition from newer and more affordable EV brands.

Tesla revolutionized the electric vehicle industry, but the EV landscape is changing fast. New competitors are emerging, consumer preferences are shifting, and brand perception is more important than ever. While production challenges might be part of the problem, the bigger issue seems to be the “Elon Effect”—and how it’s impacting Tesla’s public image.

The next few months will be crucial in determining whether Tesla bounces back or continues its downward trajectory. One thing’s for sure: 2025 is shaping up to be a defining year for the EV giant. What do you think? Is Tesla’s sales decline temporary, or is it a sign of bigger trouble ahead? Let us know in the comments!

Related Post