Tesla (TSLA), the pioneering electric vehicle (EV) manufacturer, has unveiled its production and delivery numbers for the fourth quarter and full year 2024. While the company broke a quarterly delivery record, it fell short of analyst expectations and its own ambitious guidance. Here’s a closer look at the highlights, challenges, and implications for Tesla’s future.

Q4 2024 Deliveries: Record Numbers but Below Expectations

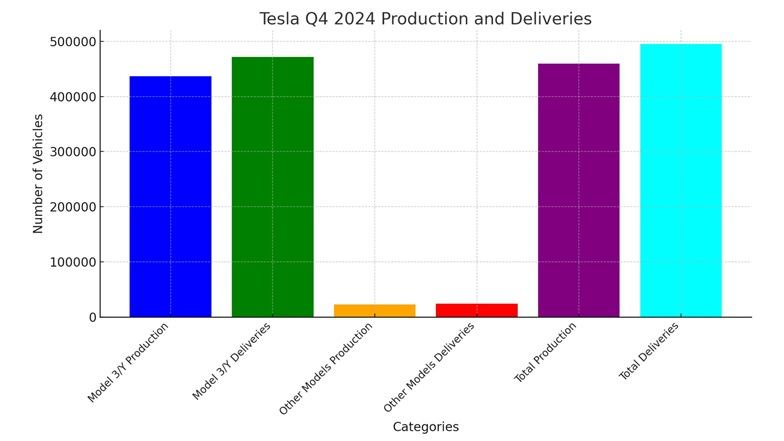

Tesla reported 495,570 vehicle deliveries in the fourth quarter, missing the analyst consensus of 507,000 units and its internal goal of exceeding 515,000. This shortfall marks a significant deviation from expectations, especially given Tesla’s aggressive discounts and incentives during the quarter.

Key Figures:

- Total Production: 459,445 vehicles

- Total Deliveries: 495,570 vehicles

- Breakdown by Model:

- Model 3/Y:

- Production: 436,718 units

- Deliveries: 471,930 units

- Subject to Operating Lease Accounting: 5%

- Other Models (e.g., Model S/X, Cybertruck):

- Production: 22,727 units

- Deliveries: 23,640 units

- Subject to Operating Lease Accounting: 6%

- Model 3/Y:

While the delivery numbers represent a new quarterly record for Tesla, they signal a 1% decline in annual deliveries compared to the 1,808,581 vehicles delivered in 2023. This is a sharp contrast to the impressive 38% growth Tesla achieved in 2023 versus 2022.

Aggressive Incentives to Boost Sales

To achieve these results, Tesla rolled out its most extensive discounts and incentives in history. These included:

- Direct price cuts on various models.

- Referral bonuses for customers.

- Perks like free Supercharging and complimentary Full Self-Driving packages.

Despite these measures, the automaker’s inability to meet its delivery targets highlights the growing challenges in maintaining its dominant position in the competitive EV market.

A Shifting Market Landscape

Tesla’s slight decline in deliveries comes at a time when the global EV market (excluding Tesla) is growing. This is particularly noteworthy as Tesla expanded its product lineup with the introduction of the Cybertruck and had its factories operating at full capacity.

The Broader Context:

- Automotive Market Trends: While the overall automotive market has been sluggish, the EV sector is thriving worldwide. Tesla’s decline contrasts sharply with this trend.

- Leadership Dynamics: Normally, such results might prompt leadership changes in many companies. However, Tesla’s CEO, Elon Musk, maintains tight control over the board and enjoys unwavering support from loyal shareholders, often prioritizing long-term vision over short-term fundamentals.

Energy Storage: A Bright Spot in the Results

Amid the challenges in the automotive sector, Tesla’s energy storage business provided a silver lining. The company deployed a record 11 GWh of energy storage in Q4 2024 through its Megapack and Powerwall products. This reflects significant growth in a segment that could play a crucial role in Tesla’s future diversification and revenue streams.

Analysis: What Went Wrong?

Tesla’s Q4 shortfall can be attributed to several factors:

- Overly Ambitious Guidance: Tesla’s rare delivery guidance for Q4, which aimed for slight growth compared to 2023, turned out to be overly optimistic.

- Intense Market Competition: Rivals in the EV space are gaining ground with competitive pricing, advanced features, and strong brand loyalty.

- Heavy Reliance on Incentives: Despite unprecedented discounts and perks, Tesla struggled to convert this strategy into substantial growth, raising questions about the elasticity of its demand.

Stock Market Reaction

Tesla’s stock initially rose by nearly 2% in pre-market trading but slid 3% following the announcement of the delivery results. This reflects investor disappointment, especially given the contrast between Tesla’s past growth trajectory and the current stagnation.

Production | Deliveries | |

| Model 3/Y | 1,679,338 | 1,704,093 |

| Other Models | 94,105 | 85,133 |

| Total | 1,773,443 | 1,789,226 |

Looking Ahead: Challenges and Opportunities

Tesla’s Q4 performance underscores the evolving dynamics of the EV market. Here are the key takeaways for the future:

Challenges:

- Sustaining Growth: Tesla must find new ways to drive demand without relying excessively on discounts.

- Product Diversification: With the Cybertruck now part of the lineup, Tesla must ensure it meets production and delivery expectations to capitalize on its popularity.

- Market Competition: As global EV sales rise, Tesla faces mounting pressure from established automakers and new entrants offering compelling alternatives.

Opportunities:

- Energy Storage Expansion: Tesla’s record deployment in this segment suggests significant potential for growth beyond automotive.

- Technological Leadership: Maintaining a technological edge, particularly in battery technology and autonomous driving, could help Tesla retain its position as an industry leader.

- Global EV Demand: The increasing worldwide demand for EVs presents a long-term growth opportunity, provided Tesla can address its immediate challenges.

Tesla’s Q4 2024 results serve as a reminder that even market leaders are not immune to challenges. While the company’s record deliveries highlight its resilience, missing guidance and slowing growth indicate the need for strategic recalibration. Tesla’s ability to adapt to these dynamics will determine whether it can sustain its dominance in the ever-expanding EV market.

With a growing energy business and a loyal customer base, Tesla remains a key player in the global transition to sustainable energy. However, to maintain its lead, the company must balance innovation, market expectations, and competitive pressures in the years ahead.

Related Post