Electric vehicles (EVs) were once seen as a luxury, far out of reach for the average consumer. While they’re still pricier than their gas-powered counterparts in many regions, especially outside China, the gap is closing at a surprising pace. New data from Jato Dynamics reveals that EVs are becoming more affordable, driven by declining battery costs and a growing variety of budget-friendly models. Here’s a closer look at how EV pricing is evolving globally and what it means for the future of transportation.

The Global EV Price Drop

In December 2024, the average price of an EV in the U.S. was $55,000, about 12% higher than the average cost of a gas-powered car. But here’s the exciting part: EV prices have fallen significantly over the past few years.

According to Jato Dynamics’ report, “EV Price Gap: A Divide in the Global Automotive Industry,” the average EV price has dropped by 25% since 2018. In the U.S., the price gap between EVs and internal combustion engine (ICE) vehicles has narrowed dramatically—from a 50% difference in 2021 to just 15% in 2023.

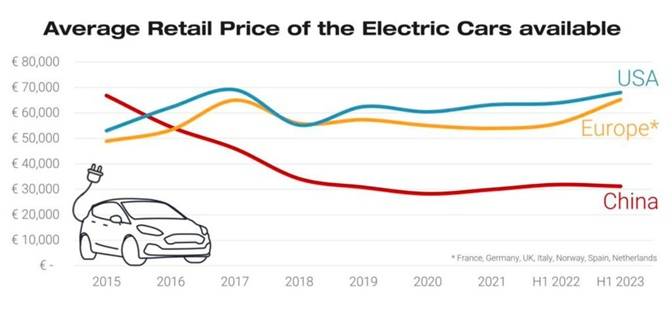

Europe has seen a similar, albeit slower, trend. While the price gap was 27% in 2023, it briefly widened to 29% in 2022 before narrowing to 22% in 2024. However, Europe and the U.S. still lag behind China, where EVs are far more affordable.

Why EVs Are Cheaper In China

China stands out as a global leader in EV affordability. In the first half of 2022, the average price of a new EV in China was $33,400 (€31,829), compared to $58,600 (€55,821) in the European Union and $67,000 (€63,864) in the United States. By 2023, the price gap had widened further, with EVs in Europe costing 115% more than in China and those in the U.S. costing 118% more.

Why are EVs so much cheaper in China? A few key reasons:

- Affordable Options: Nearly 80% of EVs sold in China in 2023 cost under $42,000 (€40,000), and a third were priced under $21,000 (€20,000).

- Economies of Scale: China’s massive EV market—40% of all car sales in 2024 were plug-in hybrids or battery electric vehicles (BEVs)—enables manufacturers to produce vehicles at a lower cost.

- Localized Production: Many EV components, especially batteries, are manufactured domestically, reducing costs.

For example, a Volkswagen ID.4 Pro sold in China costs about 30% less than the same model in the U.S. Even with the $7,500 federal tax credit (which many U.S. EVs no longer qualify for in 2025), China’s EV pricing remains unmatched.

Why EV Prices Are Falling Worldwide

Several factors contribute to the declining cost of EVs globally:

- Lower Battery Costs: Battery production, which accounts for a significant portion of an EV’s price, has become cheaper thanks to technological advancements and increased production capacity.

- Increased Competition: The growing number of EV manufacturers and models has driven prices down.

- Government Incentives: Subsidies and tax credits in many countries have made EVs more accessible to consumers.

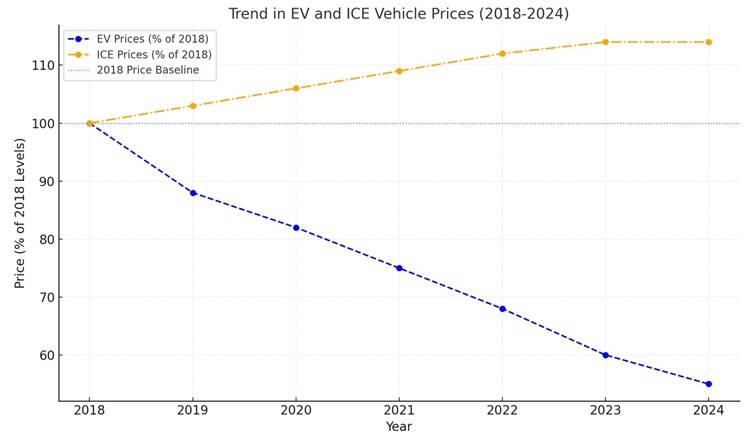

Interestingly, the narrowing price gap isn’t just about EVs getting cheaper. ICE vehicles have also become more expensive. Felipe Munoz, Global Analyst at Jato Dynamics, explains that stricter regulations, advanced tech features, and higher production costs have driven up ICE vehicle prices.

Between 2018 and 2024, the average price of ICE vehicles rose by 14%, while EV prices fell by 11%. This dual trend has accelerated the shift toward EV affordability.

Progress with Room for Growth In US Market

In the U.S., EV prices have made significant strides. Kelley Blue Book reported that the average price of a new EV in July 2024 was $56,520, compared to $48,401 for ICE vehicles—a 16.8% difference. While EVs are still more expensive, the gap has shrunk dramatically from 53% in 2018 to 15% in 2024.

However, challenges remain. The federal tax credit, which previously made EVs more affordable, is becoming less impactful. Many EVs no longer qualify, and political changes could further reduce or eliminate these incentives.

Despite these hurdles, the U.S. market is making progress. A wider variety of EV models and increased production are helping bridge the affordability gap.

Europe: Slow but Steady Progress

In Europe, the EV market is also seeing improvements, though at a slower pace than in the U.S. and China. By 2024, the price gap between EVs and ICE vehicles had narrowed to 22%. However, high taxes, stricter emission regulations, and production costs keep EV prices higher in Europe compared to China.

Here is the graph showing the trend in EV and ICE vehicle prices from 2018 to 2024, relative to their 2018 levels. It highlights the significant drop in EV prices and the gradual increase in ICE vehicle prices over the years.

What This Means for the Future of EVs

The global trend toward more affordable EVs is a positive sign for the automotive industry and the environment. As the price gap continues to shrink, more consumers will have access to electric cars, accelerating the transition to cleaner transportation.

China’s model of producing and selling affordable EVs could serve as an example for other regions. Increased competition, innovation, and government support will play a crucial role in making EVs accessible worldwide.

Electric vehicles are no longer a luxury reserved for the wealthy. With prices dropping and more affordable models hitting the market, EVs are becoming a realistic option for many consumers. While challenges remain—especially in regions like the U.S. and Europe—the overall trend is clear: EVs are becoming more affordable, and the future of transportation is electric.

As battery costs continue to decline and governments push for greener policies, the day when EVs are as affordable—or even cheaper—than gas-powered cars is closer than ever. For consumers, this means more choices, better technology, and a cleaner future.

Related Post