For many Americans, the promise of a hefty tax credit is the final push they need to jump into the world of electric vehicles (EV Sales). And in December, that incentive appeared to be more powerful than ever. According to new data from S&P Global Mobility, EV registrations surged by 25% in the final month of 2024, marking a clear shift in consumer behavior. But what exactly drove this spike? Was it the usual end-of-year deals, or were buyers rushing to take advantage of the $7,500 EV tax credit before potential policy changes under then-President-elect Donald Trump?

December is typically a strong month for car sales, thanks to end-of-year discounts and dealership promotions. However, this past December was particularly notable for the EV market. Many buyers likely scrambled to secure their tax credit before a possible policy shift, fearing that Trump would follow through on his promise to eliminate the incentive.

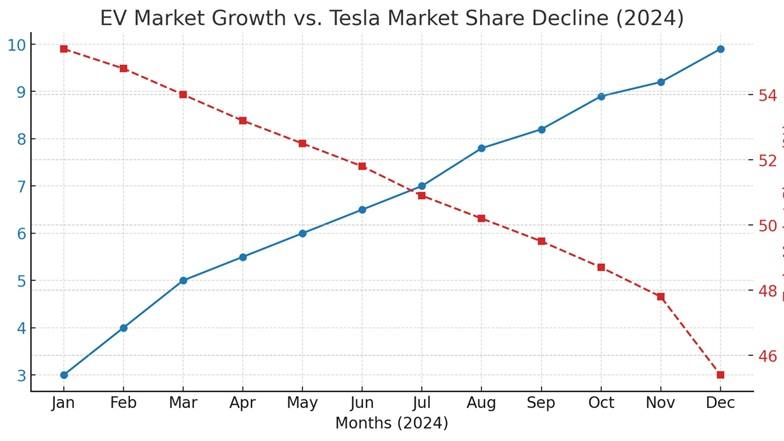

Across the board, EV brands saw a significant uptick in sales. Leading the charge, as expected, was Tesla, which registered a staggering 65,455 new vehicles in December alone. Despite this impressive number, it wasn’t enough to prevent Tesla from experiencing its first-ever year-over-year sales decline. In fact, the company’s market share dropped by 10 percentage points compared to 2024, settling at 45.4% for the month.

Ford and Chevrolet Make Big Moves

While Tesla remained the dominant player, other manufacturers made substantial gains. Ford and Chevrolet both saw impressive growth, driven largely by their expanding EV lineups.

- Ford’s Mustang Mach-E and F-150 Lightning were key players in the company’s success, helping the automaker maintain its position as Tesla’s closest competitor.

- Chevrolet crossed the 10,000-unit threshold, with the Equinox EV leading the charge. The Equinox alone accounted for 6,375 registrations, proving that well-priced, mass-market EVs can attract a broad consumer base.

One of the biggest surprises came from a General Motors partner: Honda’s Prologue. The Ultium-powered crossover racked up 7,583 registrations, making it a strong contender in the growing EV market. Between the Chevy Equinox EV and the Honda Prologue, it’s clear that affordable, well-designed EVs have the potential to win over mainstream buyers.

EV Market Growth

Despite the December spike, overall EV market growth in 2024 was relatively modest at just 11%. December’s total EV market share sat at 9.9%, a respectable number but still falling short of automakers’ expectations. Industry experts had hoped for a more significant shift toward electrification, but a combination of factors—including pricing, infrastructure concerns, and consumer hesitation—has kept growth steady rather than exponential.

Ed Kim, President of AutoPacific, described December’s surge as “abnormal,” attributing the increase to the widespread expectation that the EV tax credit might soon be eliminated. This fear-driven purchasing behavior boosted sales, but it also raises concerns about what will happen if and when the incentive disappears.

While EVs are gaining traction, another trend is emerging: hybrids are cutting into EV market share. Analysts suggest that consumers are increasingly turning to hybrids as a middle ground—offering improved fuel economy without the range anxiety or higher price tags of fully electric models.

Manufacturers like Honda and Toyota have capitalized on this trend, flooding the market with hybrid options that appeal to budget-conscious and cautious buyers. According to S&P Global Mobility analyst Tom Libby, it’s understandable that hybrids are slowing EV adoption, but he also emphasized that EV sales continue to grow, even if at a slower pace.

“There’s so much discussion about how EVs have slowed down—and they have—but they certainly have not stopped growing,” Libby noted. “EVs are alive, and they’re kicking.”

EV Market Growth and Key Insights (December 2024 Data)

| Category | Details |

|---|---|

| EV Sales Growth | 25% increase in December 2024 (compared to previous months) |

| Total EV Market Growth (2024) | 11% growth over the year |

| December EV Market Share | 9.9% of total car sales |

| Main Factor Behind Growth | Anticipation of losing the $7,500 EV tax credit |

| Top EV Brands | Tesla (65,455 registrations) – Market share: 45.4% |

| Tesla’s Market Share Change | Decreased by 10 percentage points from 2023 |

| Strongest Domestic Competitors | Ford (Mustang Mach-E, F-150 Lightning) |

| Chevy’s EV Sales | 10,000+ units, led by Equinox EV (6,375 registrations) |

| Honda Prologue Impact | 7,583 registrations (a surprise success) |

| Key Trend: Hybrid Impact | Hybrids (Toyota, Honda) slowing BEV growth |

| Future Prediction | Short-term EV sales boost in 2025 until the tax credit is eliminated |

The Hybrid vs. EV Debate

Not everyone sees hybrids as the ideal stepping stone to full electrification. Andy Palmer, former CEO of Aston Martin, has even described hybrids as “a road to hell” in the race against China’s rapidly advancing EV industry. While hybrids may be more appealing to American consumers in the short term, the global push for full electrification could put U.S. automakers at a disadvantage if they lag behind in EV production.

Countries like China and many European nations are accelerating their shift to EVs, with government policies and incentives pushing automakers to innovate. If U.S. manufacturers focus too heavily on hybrids rather than expanding their EV capabilities, they could find themselves struggling to compete on the global stage.

With uncertainty surrounding federal incentives, analysts predict that EV sales will continue to surge throughout 2025—at least until the tax credit is officially removed. If the credit is eliminated, we could see a sharp decline in EV adoption, making it even harder for automakers to reach their ambitious electrification goals.

For consumers, the message is clear: if you’re considering an EV, now might be the best time to buy. Automakers can only offer so many discounts and incentives to offset higher prices, and without the federal tax credit, EVs could become less affordable for the average buyer.

The surge in EV registrations in December highlights just how influential financial incentives can be in driving consumer behavior. But with the future of the tax credit uncertain, the EV industry faces both challenges and opportunities. While hybrids are gaining traction and slowing the pace of full EV adoption, the long-term shift toward electrification remains inevitable.

As automakers navigate these shifting market dynamics, one thing is clear: the road to an electric future isn’t a straight line—but it’s a path that continues to move forward. Whether tax credits stay or go, the demand for affordable, practical EVs is here to stay. The real question is: how quickly can the industry adapt to keep up?

Related Post