Tesla has long captured global attention, not just for its cutting-edge electric vehicles, but also for CEO Elon Musk’s bold visions of the future. From launching cars into space to pushing toward full autonomy, Musk never shies away from big swings. But sometimes, those swings miss—and recent reports suggest one of Tesla’s most significant decisions might have done just that.

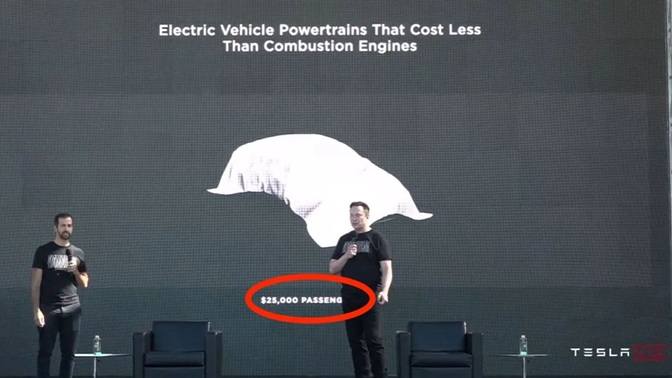

According to an in-depth report by The Information, Elon Musk reportedly dismissed internal warnings from top Tesla executives that the company’s much-hyped Robotaxi plans—now known as the “Cybercab”—would not be profitable. Instead of listening to their advice, Musk shut down plans for a more affordable $25,000 EV (nicknamed the “Model 2”), pushing forward with his vision of a driverless future.

Tesla’s “Model 2” was set to be a game-changer. Built on the company’s next-gen “unboxed” platform, it was envisioned as a compact, efficient EV priced around $25,000. This move would have made Tesla vehicles more accessible to a broader audience, especially as EV competition intensifies globally. It had all the ingredients of a hit: affordability, brand reputation, and new technology.

However, early in 2024, Musk abruptly canceled those plans. His reasoning? He believed the future wasn’t in personal car ownership, but in fleets of fully autonomous Robotaxis ferrying people around cities. And so, the focus shifted to the “Cybercab”—a self-driving vehicle built for ride-sharing, not individual buyers.

Tesla Execs Say “Not So Fast”

Musk’s decision didn’t sit well with everyone inside Tesla. In February 2024, a major meeting took place at Tesla’s Palo Alto offices. Several senior executives—including Daniel Ho (head of vehicle programs), Drew Baglino (SVP of engineering), Rohan Patel (head of policy), Lars Moravy (VP of vehicle engineering), and chief designer Franz von Holzhausen—made one last push for the Model 2.

Their argument was simple: build both the affordable Model 2 and the Robotaxi. That way, Tesla could serve current markets and still chase the futuristic dream of autonomy. But Musk wasn’t having it. He flatly rejected the $25,000 car, calling the idea “silly” and “pointless.” In his view, the world would soon shift away from individual car ownership entirely—and Tesla needed to lead that charge.

To support their case, Tesla’s internal analysts created a detailed report. While they followed Musk’s assumptions—like high utilization rates for robotaxis and people giving up private car ownership—the math painted a different picture.

Here are the key findings:

- Limited Demand: Even under ideal conditions, the report estimated a market for only about 1 million robotaxis annually. That’s far less than Tesla’s current sales volume in the U.S. alone.

- Saturated Market: Not everyone wants to be “ferried around” in a shared car. The lifestyle shift required for widespread adoption of robotaxis is significant and not guaranteed.

- Financial Concerns: Robotaxis were estimated to generate $20,000–$25,000 at sale, and potentially triple that amount through ride revenue. But those projections included heavy spending on infrastructure like charging stations, maintenance depots, and software support.

- Global Expansion Issues: Regulatory challenges outside the U.S. could make launching robotaxis internationally slow and difficult—further limiting profitability.

- Long-Term Losses: The analysis concluded that the robotaxi strategy could bleed money for years before turning any profit—if it ever does.

One executive reportedly said:

“There is ultimately a saturation of people who want to be ferried around in somebody else’s car.”

This grounded analysis directly clashed with Musk’s earlier claims that Tesla robotaxis could be worth $100,000–$200,000 each due to their increased utility.

For many investors and fans, Tesla is seen as the world’s leading electric vehicle company. But internally, it’s becoming something else entirely: an AI-focused, autonomy-obsessed tech firm. The pivot from producing affordable EVs to betting everything on full self-driving has real consequences.

- Only one new vehicle launch in 5 years: The Cybertruck, which has so far underperformed commercially.

- No affordable Tesla for the mass market: A space now rapidly filling with offerings from BYD, Hyundai, and even GM.

- Leadership turnover: Reports suggest this strategic shift contributed to an exodus of top Tesla talent last year.

- Flatlining sales: With fewer fresh products and increasing competition, Tesla’s U.S. sales are stalling.

- Shareholder uncertainty: Elon Musk continues to sell the Robotaxi dream, but if that dream turns into a costly delay, confidence could erode.

Perhaps most concerning is the way this decision was made. According to The Information, Musk disregarded the input of his most senior engineers, designers, and strategists. When someone in the meeting asked if a “mutiny” was brewing, it reflected the internal tension at Tesla.

It’s not the first time Musk has gone against the grain, but this time, the stakes are much higher. Unlike building rockets or tunnels, Tesla is now a mature company with shareholders, global factories, and stiff competition.

What happens if the robotaxi gamble fails?

There’s no denying Musk’s genius for innovation—but genius can be dangerous when it ignores grounded reality. The world may one day shift to autonomous ride-sharing, but we’re not there yet. Most people still want to own their cars. And in a time when affordability is a key concern for EV buyers, walking away from a $25,000 Tesla seems like a major misstep.

Tesla doesn’t need to abandon the Robotaxi dream. But betting the entire future of the company on it, while ignoring a proven strategy of producing affordable EVs, is a risky game. For now, investors, fans, and even Tesla’s own employees are left wondering: has Musk’s obsession with autonomy blinded him to the real road ahead?

Related Post