Electric cars (EVs) are not just the future of transportation—they’re rapidly becoming the present. Despite fluctuating trends and economic uncertainties, interest in EVs has reached a tipping point worldwide. According to a new survey by Accenture, a leading IT and consulting firm, a majority of drivers globally are considering switching to EVs within the next decade. This article delves into the key findings of this survey, highlighting regional differences, evolving consumer priorities, and what these trends mean for the EV industry.

1. Rising EV Demand: United States vs. Global Trends

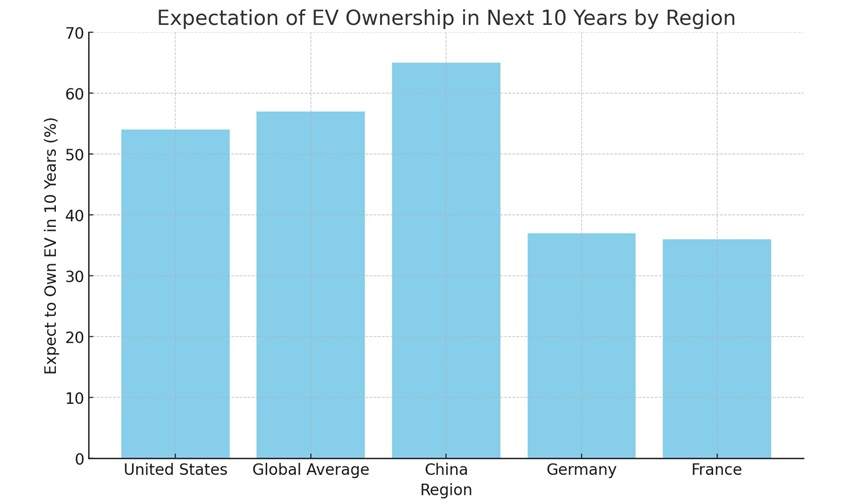

The survey reveals a significant shift in consumer sentiment, with more drivers expecting to go electric. In the United States, 54% of respondents plan to own an EV within the next 10 years, while globally, this number climbs to 57%. This discrepancy is largely influenced by China’s rapid adoption of EVs, where the culture of green mobility is becoming more mainstream.

Key Statistics from the Survey:

| Region | Expect to Own EV in 10 Years | Will Never Buy EV |

|---|---|---|

| United States | 54% | 11% |

| Global Average | 57% | 10% |

| China | 65% | N/A |

| Germany | 37% | N/A |

| France | 36% | N/A |

These numbers highlight a noticeable difference in EV enthusiasm, with countries like China leading the charge in EV adoption. Meanwhile, in Europe, enthusiasm varies significantly by country, as evidenced by declining all-electric vehicle registrations in Germany and growth in Belgium and the Netherlands. This fluctuation allowed the United States to emerge as the world’s second-largest EV market in Q3, just behind China.

2. What Consumers Want in an EV

EV adoption is no longer just about sustainability. As interest in EVs grows beyond early adopters, new consumers are bringing different expectations and priorities. The Accenture survey shows that the top criteria for potential EV buyers are reliability, safety, and value for money, mirroring the expectations of traditional car buyers. This shift implies that the “green factor” alone is no longer enough to win over new buyers; practical considerations are now central.

| Key Priorities for EV Buyers | Percentage of Respondents |

|---|---|

| Reliability | 83% |

| Safety | 82% |

| Value for Money | 82% |

| Battery Range | 81% |

For a significant majority, reliability and safety are top priorities, with value for money close behind. Battery range, another critical consideration, is particularly essential as 81% of respondents rated it as a key factor. The survey indicates that mainstream buyers now see EVs as an established technology and are concerned with the same practical attributes they would consider in a traditional combustion engine vehicle.

3. Charging Infrastructure and Range Anxiety

Charging availability and driving range remain among the top concerns for potential EV buyers. About 70% of survey respondents expect easy access to charging options, whether at home or in public locations such as parking lots and supermarkets. While charging infrastructure has improved in many urban areas, the widespread availability of reliable charging remains a crucial hurdle in rural and suburban regions.

Range anxiety, or concerns about an EV’s battery range, also plays a significant role in consumers’ buying decisions. With an increasing number of EV models offering ranges above 300 miles, this issue is becoming less pronounced, but it’s still a crucial consideration for prospective buyers, especially those unfamiliar with EVs.

4. Country-Specific Insights: China, United States, and Europe

The Accenture survey highlights unique preferences and rates of adoption across various countries. Here’s a closer look at how different regions view the future of EVs:

- China: China remains a frontrunner in EV adoption, with 65% of drivers believing that EVs are the future. Nearly half (44%) of non-EV owners in China plan to buy an EV within the next five years, reflecting the country’s rapid embrace of green technology.

- United States: Although the U.S. trails behind China in EV adoption, interest is steadily increasing. With 54% of drivers expecting to switch to an EV in the next decade, the country is experiencing growth driven by state incentives, expanding infrastructure, and a wider selection of EV models.

- Europe: Europe shows varied interest levels by country. Germany, for instance, has seen a recent decline in EV sales, potentially due to decreased government subsidies and higher vehicle prices. In contrast, Belgium and the Netherlands are seeing growth in EV adoption, highlighting the complex landscape of consumer sentiment across the continent.

EV Adoption Rates by Country

| Country | EV Ownership Intent (Next 10 Years) | Planned Purchase (Next 5 Years) |

|---|---|---|

| China | 65% | 44% |

| United States | 54% | N/A |

| Germany | 37% | N/A |

| France | 36% | N/A |

Here is the table showing the key survey results for EV adoption expectations and buying intentions:

| Region | Expect to Own EV in 10 Years (%) | Will Never Buy EV (%) | Plan to Buy EV in Next 5 Years (%) |

|---|---|---|---|

| United States | 54 | 11 | N/A |

| Global Average | 57 | 10 | 23 |

| China | 65 | N/A | 44 |

| Germany | 37 | N/A | N/A |

| France | 36 | N/A | N/A |

This data highlights how each region perceives EV ownership over the coming decade. The bar graph further illustrates the expectation of owning an EV within 10 years by region.

5. What This Means for the EV Industry

The survey provides essential insights for car manufacturers, underscoring the need to produce affordable, reliable, and versatile EVs that meet a wide range of consumer needs. With a more extensive selection of EV models now available—from high-end $200,000 electric vehicles to budget-friendly options below $30,000—automakers are positioning themselves to appeal to this broader, more mainstream audience.

6. Key Points at a Glance

- Global EV Interest: 57% of drivers worldwide expect to own an EV within 10 years.

- Top Priorities for Buyers: Reliability, safety, and value for money are now paramount for EV consumers.

- Charging Accessibility: 70% of drivers want convenient access to charging stations.

- Regional Differences: China leads in EV adoption, while Europe shows varied growth patterns.

- Market Response: Automakers are expanding EV offerings across price ranges to attract mainstream buyers.

The Accenture survey paints a promising picture for the future of EVs, with a steady increase in consumer interest across different regions. While hurdles remain—such as infrastructure development and the high cost of entry—these challenges are unlikely to impede the growing momentum of electric vehicles. As car manufacturers respond to consumer demand with more diverse, accessible EV options, the shift toward an all-electric future seems more achievable than ever.

Related Post