Cleantech Investments Set to Surpass Fossil Fuels: What 2025 Holds for Renewable Energy

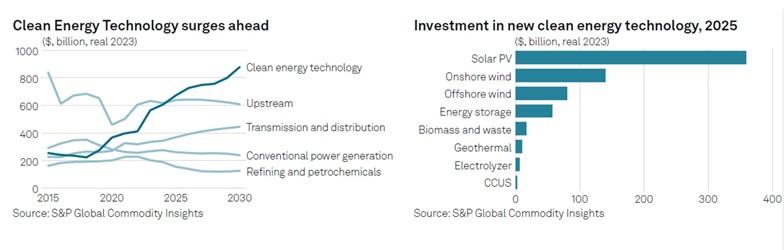

For the first time in history, global investments in cleantech are poised to outpace spending on upstream oil and gas in 2025, according to a groundbreaking report from S&P Global Commodity Insights. With $670 billion projected to flow into clean technologies, this milestone represents a significant shift in the global energy landscape. Solar energy is leading the charge, with solar photovoltaic (PV) systems alone accounting for half of these investments and two-thirds of all newly installed energy capacity.

While this achievement is worth celebrating, it’s not enough to meet ambitious climate goals. As Eduard Sala de Vedruna, head of research at S&P Global, warns, renewable energy capacity must triple by 2030 to stay on track with global climate targets. This pivotal moment brings both challenges and opportunities, signaling that the clean energy sector is entering a transformative phase.

Here are five key trends from S&P Global’s “Top Cleantech Trends for 2025” report that highlight where the industry is heading—and where there’s still work to be done.

Cleantech Investments Surpass Fossil Fuels

In 2025, renewable energy investment will finally overtake fossil fuel spending, marking a turning point in the energy sector. Solar PV systems are the star performers, driving most of this growth. However, the report underscores that the current pace of investment still falls short of what’s needed to combat climate change effectively.

Interestingly, capital efficiency in renewable energy varies widely across countries. For instance, China is able to deploy almost double the gigawatts per dollar compared to the U.S., highlighting the disparity in deployment strategies.

China’s Cleantech Dominance Faces Challenges

China has long been a global leader in cleantech manufacturing, producing the majority of the world’s solar panels, wind turbines, and battery cells. However, its dominance may begin to wane. By 2030, China’s market share in PV module production is expected to drop to 65%, while its share of battery cell manufacturing may decline to 61%.

Oversupply from China has kept prices low for years, but the report suggests these price declines may level off in 2025. Compounding this is China’s slowing economy, which could hinder its ability to maintain its vast supply chains. This shift opens the door for other regions to expand their manufacturing capabilities and reduce reliance on Chinese imports.

Batteries Are Reshaping Energy Markets

Battery energy storage is becoming a cornerstone of renewable energy projects, solving key financial and operational challenges. One such challenge is “cannibalization,” where excessive energy production during peak periods, such as midday when solar output is highest, drives down market prices.

By storing excess energy and selling it when prices rebound, battery systems make renewable energy projects more viable and competitive. Expect to see batteries play an increasingly pivotal role in stabilizing grids and enabling broader adoption of solar and wind power.

AI Optimizes Renewable Energy

Artificial intelligence is emerging as a transformative force in the clean energy sector. AI-powered tools are improving energy forecasting, helping grid operators better manage fluctuations in renewable energy production.

For example, AI-based trading platforms are addressing the substantial risks associated with discrepancies—sometimes as large as 700%—between forecasted and actual energy generation. These tools allow operators to optimize energy distribution, reducing waste and improving reliability.

However, the integration of AI also raises challenges. Cybersecurity risks, ethical concerns, and data management issues are becoming increasingly critical as AI takes on a larger role in energy markets.

Data Centers Double Down on Renewables

Data centers, which are essential for powering the internet, are significantly increasing their demand for clean energy. By 2030, they are expected to source 300 terawatt-hours (TWh) of renewable energy annually, up from 200 TWh today.

North America is leading this shift, with its data centers projected to account for 60% of global growth. Major tech companies are taking proactive steps to transition their operations to clean energy, underscoring their commitment to sustainability.

The trends outlined above signal that 2025 will be a defining year for the clean energy sector. As renewable energy investments surpass fossil fuels for the first time, the world is clearly moving toward a more sustainable energy future.

However, significant challenges remain. Renewable capacity needs to expand at an unprecedented pace to meet global climate goals. Supply chain dynamics, particularly China’s role, will continue to evolve, and advanced technologies like batteries and AI must be optimized to ensure the stability and affordability of renewable energy.

Key Takeaway: While the progress is undeniable, achieving a sustainable energy future will require a combination of innovative technology, increased investment, and global cooperation. The steps taken in 2025 could set the stage for a cleaner, greener planet in the decades to come.

Related Post