President-elect Donald Trump recently unveiled a bold plan that could reshape global trade and disrupt industries (U.S. EV market), including the booming electric vehicle (EV) sector. Announcing his intent to impose a sweeping 25% tariff on all goods imported from Canada and Mexico, Trump has reignited debates on trade policies. This tariff, combined with additional duties on Chinese goods, could spell challenges for automakers heavily reliant on international supply chains. Let’s break down the key elements of this policy, its potential impact on the U.S. EV market, and what it means for automakers worldwide.

The Tariff Plan: What’s on the Table?

Trump’s proposed tariff involves:

- A 25% tax on all imports from Canada and Mexico.

- A 10% increase in tariffs on Chinese-made goods, adding to the existing 100% duty on Chinese EVs.

- A continued ban on Chinese software in vehicles sold in the U.S.

This strategy aims to bolster domestic manufacturing and reinforce his “America-first” economic policies. However, the implications could be far-reaching, especially for industries like automotive manufacturing, where cross-border supply chains are integral.

EVs at Risk: A Booming Market Faces Uncertainty

The EV market in the U.S. has been on an upward trajectory, fueled by affordable models and growing consumer interest. Automakers have enjoyed consecutive quarters of record sales growth, but Trump’s tariff plan threatens to stall this momentum.

Why EVs Are Vulnerable

- Cross-Border Manufacturing: Major automakers, including General Motors (GM), Ford, Tesla, and Honda, rely on Mexican facilities for assembling popular EV models like:

- Ford Mustang Mach-E

- Chevrolet Equinox EV

- Honda Prologue

- Supply Chain Dependencies: Even Tesla, which manufactures its vehicles in the U.S., sources key components from Mexico.

- Global Price Shocks: The additional tariffs could increase production costs, making EVs more expensive for consumers and slowing adoption rates.

Automakers and Tariff Impact

| Automaker | Country of Assembly | Tariff Impact | Key Models Affected |

|---|---|---|---|

| Tesla | U.S. (some parts from Mexico) | Moderate | Model 3, Model Y |

| Ford | Mexico | High | Mustang Mach-E |

| General Motors | Mexico | High | Blazer EV, Equinox EV |

| Hyundai/Kia | U.S., Korea | Low to Moderate | Ioniq 5, Ioniq 6, EV9 |

| Toyota/Lexus | Japan | Low | bZ4x, Lexus RZ |

| BMW/Audi | Europe | Moderate | Various models assembled in Mexico |

Winners and Losers of the Tariff Shift

Winners: South Korean and Japanese Automakers

South Korean and Japanese EV manufacturers may emerge as beneficiaries of this tariff policy:

- Hyundai: Models like the Ioniq 5 are now produced at its Metaplant in Georgia, shielding it from tariffs.

- Kia: The EV9 and Niro EV rely on fewer Chinese components, further insulating them.

- Toyota and Lexus: With production primarily in Japan and minimal reliance on Chinese parts, these brands are well-positioned to navigate the new policy.

Losers: American and European Automakers

- U.S. Automakers: Companies like GM and Ford, with significant production in Mexico, could face steep cost increases, potentially leading to higher vehicle prices.

- European Automakers: BMW and Audi, which assemble several models in Mexico, also stand to lose.

- Tesla: Though less reliant on imports, its use of Mexican components could still be affected.

Impact Beyond the EV Market

Supply Chain Disruption

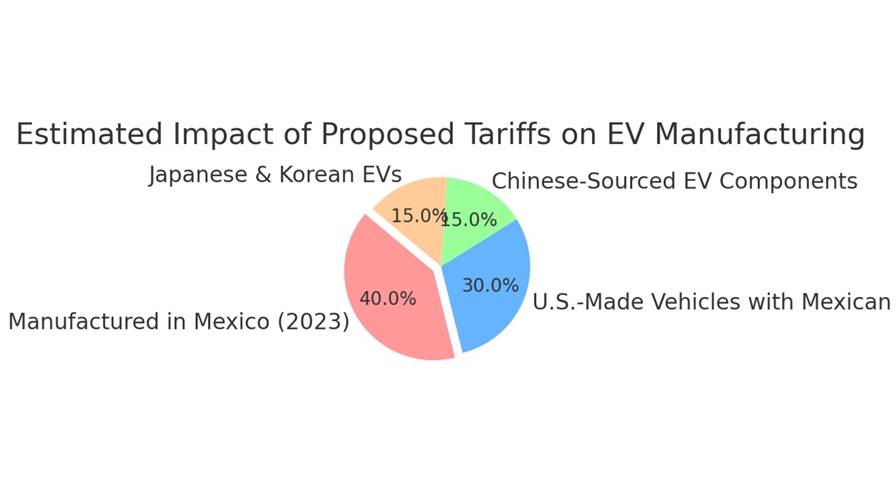

Trump’s proposed tariffs could disrupt the intricate supply chains automakers rely on, causing delays and price hikes. With 2.55 million cars manufactured in Mexico imported to the U.S. in 2023, the ripple effect on the broader automotive market could be significant.

Stock Market Reactions

Following Trump’s announcement, share prices of automakers like GM, Ford, Toyota, and Volkswagen fell, reflecting investor concerns about the potential economic fallout.

Potential Benefits of the Tariff Plan

Despite the challenges, Trump’s tariff proposal aligns with efforts to boost domestic manufacturing.

- Strengthening U.S. Manufacturing: By incentivizing local production, the policy could lead to job creation in U.S.-based plants.

- Reducing Dependency on Imports: The policy could encourage automakers to develop more self-reliant supply chains.

| Model Year 2024 EVs/PHEVs | Share of content from the U.S. or Canada | Share of content from Mexico | Share of content from China | Final Assembly |

| Ford Mustang Mach-E | 26% | 18% | 51% | Mexico |

| Chevy Blazer EV | 62% | – | 18% | Mexico |

| Chevy Equinox EV | 62% | – | 18% | Mexico |

| Honda Prologue | 38% | 16% | Mexico | |

| Acura ZDX | 63% | 19% | 16% | U.S. |

| Tesla Model 3 | 35-75% | 20% | 40% (LR only) | U.S. |

| Tesla Model Y | 70% | 20% | – | U.S. |

| Tesla Model S | 65% | 15% | – | U.S. |

| Tesla Model X | 60% | 20% | – | U.S. |

| Cybertruck | 65% | 25% | – | U.S. |

| Ford Escape PHEV | 32% | 25% | – | U.S. |

| Lincoln Corsair PHEV | 47% | 25% | – | U.S. |

| Audi Q5 55 e | – | 51% | – | Mexico |

Looking Ahead: Will the Tariffs Be Enacted?

While the plan is ambitious, its implementation remains uncertain. Industry experts suggest potential carve-outs or exemptions for companies like Tesla, whose CEO Elon Musk holds a prominent role in Trump’s administration. Additionally, the tariffs may face legal and logistical hurdles before they can be fully enacted.

Navigating the Road Ahead

Trump’s proposed tariffs represent a bold push for economic nationalism but pose significant risks to the burgeoning EV market. While South Korean and Japanese automakers appear better equipped to weather the storm, American manufacturers may face tough decisions about their supply chains and pricing strategies.

In the end, the automotive industry’s ability to adapt will determine whether this policy accelerates or slows the transition to a cleaner, electrified future. What do you think about these proposed tariffs? Are they a necessary step to protect U.S. manufacturing, or do they risk derailing progress in the EV sector? Let us know your thoughts!

Related Post