Hyundai just threw down the gauntlet in China. The South Korean automaker’s joint venture with BAIC—Beijing Hyundai—has opened pre-sales for the EO, a brand-new electric SUV built in China and tailored for local buyers. The headline grabber: a starting price of 130,000 yuan (about $18,300). In a market dominated by BYD and fast-moving local brands, Hyundai’s EO looks like a serious comeback play.

From roughly $18.3K, the EO undercuts most global rivals and runs right at BYD’s value edge. Designed for Chinese buyers and built locally, the EO is Hyundai’s first dedicated EV in China. Big LFP battery options with CLTC-rated ranges up to 722 km (448 miles) and a 30–80% fast charge in 27 minutes. Three trims, aggressive pre-sale perks, and mainstream sizing to hit the sweet spot.

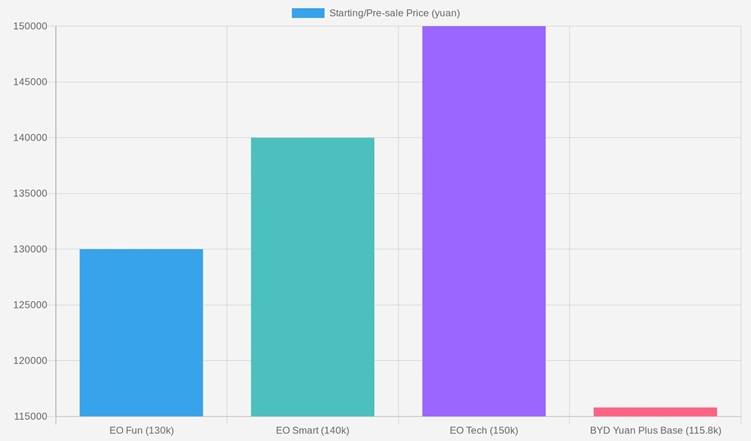

- Trims: Fun, Smart, Tech

- Pre-sale price range: 130,000–150,000 yuan (18,300–18,300–21,000)

- Platform: E-GMP (Hyundai’s dedicated EV architecture)

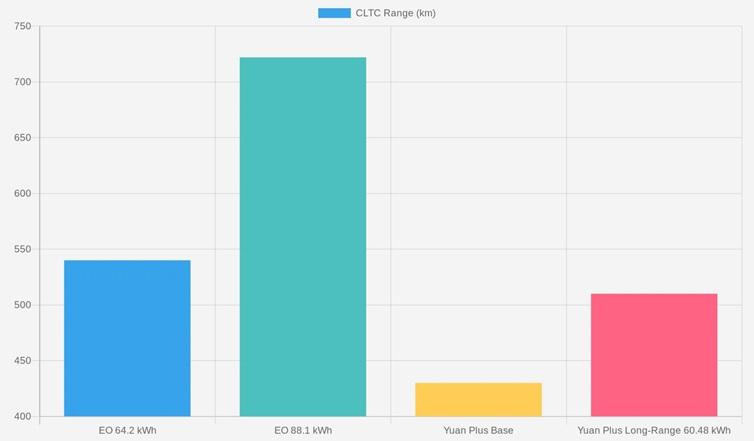

- Batteries (LFP): 64.2 kWh or 88.112 kWh

- CLTC range: 540 km (335 mi) or 722 km (448 mi)

- Powertrains: Single motor FWD (160 kW/215 hp, 310 Nm) or dual-motor AWD (233 kW/312 hp)

- DC fast charge: 30% to 80% in 27 minutes (claimed)

- Size: 4,615 x 1,875 x 1,698 mm—about the size of BYD Yuan Plus (Atto 3 overseas)

Pre-sale perks that sweeten the pot

For a limited time, an 88 yuan (12.35)deposit unlocks a package value dat 12,000 yuan( 12.35)deposit unlocks a package value dat 12,000yuan ( 1,700):

- 5,000 yuan cash subsidy

- Exclusive body colors

- Reduced insurance rates

- Home charging station

- Additional launch goodies

EO pricing and trims

| Trim | Pre-sale Price (yuan) | USD (approx.) | Key Callouts |

|---|---|---|---|

| Fun | 130,000 | $18,300 | Entry spec, LFP battery, E-GMP bones |

| Smart | 140,000 | $19,700 | Added comfort/tech |

| Tech | 150,000 | $21,000 | Top spec, more features and options |

Power, range, and charging

| Spec | EO (64.2 kWh LFP) | EO (88.112 kWh LFP) |

|---|---|---|

| CLTC range | 540 km (335 mi) | 722 km (448 mi) |

| Drivetrain options | Single motor FWD | Single motor FWD or dual-motor AWD |

| Output | 160 kW (215 hp), 310 Nm | Up to 233 kW (312 hp) combined (AWD) |

| DC fast charging | 30–80% in 27 minutes (claimed) | Same |

Note: CLTC tends to be more optimistic than EPA or WLTP. Real-world range may be lower outside China’s test cycle.

BYD’s backyard

Hyundai is aiming squarely at the BYD Yuan Plus (Atto 3 abroad), a blockbuster in China’s compact EV SUV class.

EO vs. BYD Yuan Plus (China)

| Model | Starting Price | Battery (main) | Range (CLTC) | Size class |

|---|---|---|---|---|

| Hyundai EO | 130,000 yuan ($18.3K) | 64.2 or 88.1 kWh LFP | 540–722 km | Compact SUV |

| BYD Yuan Plus | 115,800 yuan ($16.3K) | Up to 60.48 kWh | 430–510 km | Compact SUV |

BYD undercuts on price, but EO counters with larger battery options and longer CLTC range. For buyers who prioritize maximum range and a global-brand badge, EO’s value story is compelling.

Designed for China—eyes on the world?

When spy shots surfaced earlier this year, some predicted Hyundai might call this the IONIQ 4. Not so. Once unveiled in May, it was clear: the EO is a China-first design, from styling to spec. Still, Hyundai Australia’s CEO Don Romano says the EO is “under evaluation” for overseas markets. No green light yet, but the door’s open.

No, you can’t get a sub-$20K Hyundai EV stateside (yet). But Hyundai has been hustling on price: 2026 IONIQ 5 now starts under $35,000 in the U.S., making it one of the most affordable long-range EVs here. With the federal $7,500 tax credit expired as of September 30, Hyundai is leaning on promotions—up to $11,750 in lease cash on some 2025 models—to keep payments in check. Offers vary by region and change often, so check local dealers.

It proves Hyundai is willing to localize: Pricing, trim strategy, and LFP chemistry are tuned for China’s ultra-competitive arena. Can a global brand win at $18–21K with meaningful range and features? If yes, expect ripple effects well beyond China. BYD still goes lower on price, but EO’s big-battery value will force sharper specs—or sharper discounts.

Final feature lists by trim (Fun/Smart/Tech) and how the battery options map across them. 30–80% in 27 minutes is solid on paper—let’s see it on the plug. Delivery timing and production ramp in China. If markets like Australia say yes, the EO could become Hyundai’s global value EV play.

An EV for the price of a used Corolla? That’s not nothing. For Chinese families looking for a modern, safe, long-range daily driver with a recognizable global badge, the EO could hit that “right car, right price” sweet spot. And for Hyundai, it’s a statement: the brand isn’t ceding China’s EV future without a fight.

Hyundai’s EO arrives right where China’s EV action is hottest: compact SUVs with real range and real value. BYD still owns the bargain basement, but EO brings serious battery and brand equity to the table for roughly $18–21K. If Hyundai nails execution—and considers exports—the EO could be the spark for a broader Hyundai rebound in the world’s most important EV market.

Related Post