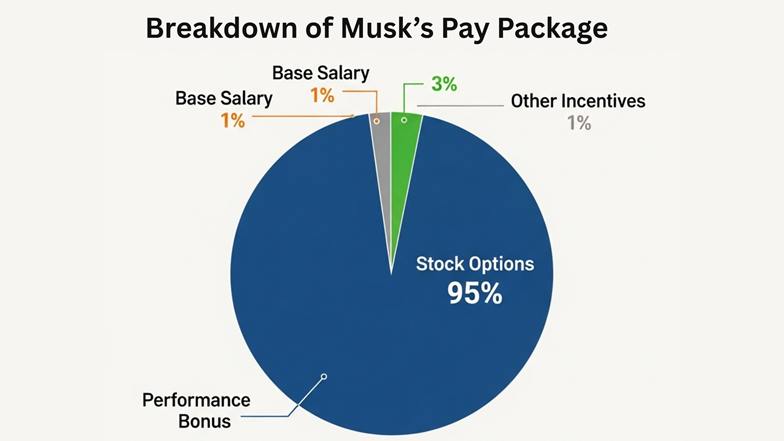

In a move that’s turning heads across Wall Street and Silicon Valley, Tesla board has officially approved a massive new $29 billion stock award for CEO Elon Musk. The big question on everyone’s mind: Will this eye-popping pay package be enough to keep Musk’s attention locked on Tesla as the electric vehicle pioneer faces some of its toughest challenges yet?

This latest compensation plan is actually smaller than the original, even more jaw-dropping package that was previously approved by shareholders but later struck down by a Delaware court. Still, $29 billion is a number that’s hard to wrap your head around—especially when you consider that it’s tied to Musk staying at Tesla and devoting a significant chunk of his time to the company over the next several years.

Industry watchers say this new deal is designed to address concerns about Musk’s focus. With Tesla entering a critical phase—think robo-taxis, Optimus robots, and the much-hyped Cybercab—the board wants to make sure their CEO is all-in. As Yahoo Finance’s Pras Subramanian put it, “It requires him to be there for a few years and devote a certain amount of time to the business.” That’s exactly what many investors and analysts, like Wedbush’s Dan Ives, have been calling for.

One important detail: If the original, much larger pay package somehow gets revived in court, Musk won’t be able to “double dip.” He’ll only be able to collect one of the two awards, not both. That should put some investors’ minds at ease, at least when it comes to the risk of Musk walking away with an even bigger payday.

Board Independence Still in Question

But not everyone is convinced this new deal solves all of Tesla’s problems. For one thing, questions about the independence of Tesla’s board haven’t gone away. Critics point out that Musk has close ties to several board members, including board chair Robyn Denholm, who is widely seen as a Musk ally. In fact, there’s only one truly independent member on the board, raising eyebrows about whether the board is really looking out for shareholders—or just rubber-stamping Musk’s wishes.

As Subramanian noted, “You have to ask that question: How independent is this board?” It’s a fair point, especially when you consider the size of the pay package and the fact that Musk himself sits on the board.

Big Pay, Big Problems

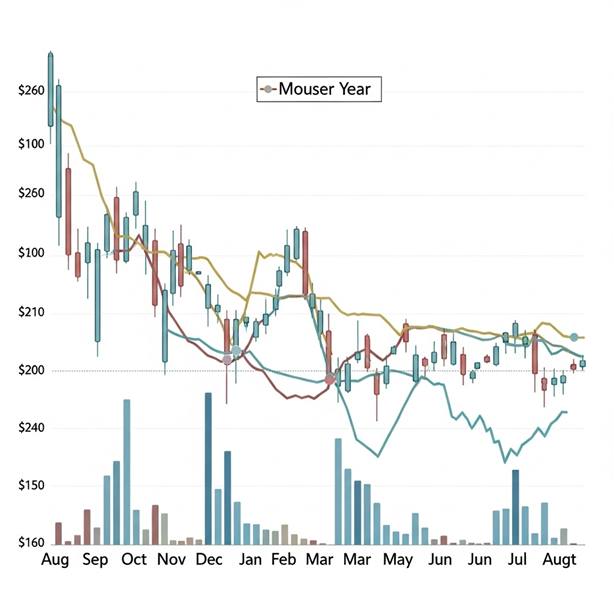

There’s also a bit of cognitive dissonance at play. On one hand, Tesla is handing out a retroactive pay package worth billions. On the other, the company’s stock is down about 25% this year, and its core auto business has been slipping quarter after quarter. Even with the new Model Y hitting the market, sales haven’t exactly rebounded.

Tesla’s much-anticipated cheaper EV is still nowhere in sight, and it’s unlikely to arrive before federal tax credits for electric vehicles start to phase out. That leaves a lot of question marks for investors who are looking for signs of growth and stability.

For Tesla shareholders, the new pay package at least brings some clarity. They know Musk is being incentivized to stick around and (hopefully) focus on steering the company through its next chapter. But with so many challenges ahead—from increased competition to slowing sales and ongoing questions about board governance—there’s still plenty of uncertainty.

At the end of the day, $29 billion is a lot of money, even for Elon Musk. Whether it’s enough to keep him laser-focused on Tesla’s future remains to be seen. But one thing’s for sure: the world will be watching.

Related Post