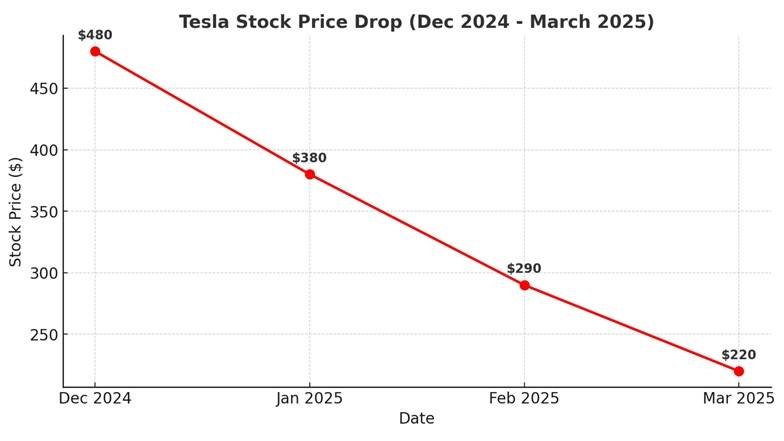

Tesla stock has taken a massive hit, plummeting more than 50% since December. The electric vehicle giant saw its stock price fall from around $480 per share in mid-December 2024 to roughly $220 by early March 2025. This dramatic decline wiped out over $800 billion in market value, making it one of the steepest drops in Tesla’s history. Even Elon Musk’s personal fortune took a massive blow, with his net worth shrinking by over $100 billion during the crash.

With so much at stake, this stock collapse is not just about Tesla—it’s a lesson in market volatility, investor psychology, and portfolio risk management. Let’s dive into what happened, why Tesla’s stock has crashed, and how investors should respond.

Tesla’s stock downturn was not a sudden event but rather a seven-week losing streak that extended into early 2025. The biggest blow came on March 10, when TSLA dropped 15% in a single day—the worst one-day loss since 2020. The plunge followed a major investment bank slashing its Tesla vehicle delivery forecasts, fueling broader market fears and investor uncertainty.

To put this into perspective, Tesla’s lost market capitalization is equivalent to the entire GDP of Poland—an astonishing level of value destruction. This collapse has made Tesla the worst-performing major tech stock of the period, raising serious concerns among investors.

So, what triggered this downfall?

- Missed Delivery Expectations: Analysts have slashed their estimates for Tesla’s vehicle deliveries, raising concerns about the company’s ability to meet future demand.

- Increased Competition: Automakers like Ford, General Motors, and global brands such as BYD are gaining ground in the EV market.

- Macroeconomic Uncertainty: Higher interest rates and inflation have reduced consumer appetite for expensive electric vehicles.

- Musk’s Controversies: Elon Musk’s unpredictable behavior and public controversies have led some investors to rethink their loyalty to Tesla.

The Impact on Tesla Investors

For Tesla shareholders, the crash has been painful. Investors who were heavily concentrated in TSLA stock have seen their portfolios shrink dramatically. Here’s a breakdown of how different investors have been affected:

- Retail Investors: Individuals who invested heavily in Tesla—sometimes making up 50% or more of their portfolio—have faced devastating losses.

- Index Funds and ETFs: Since Tesla is a significant component of major stock indices, its drop has affected diversified investment funds as well.

- Elon Musk’s Wealth: As Tesla’s largest shareholder, Musk’s personal fortune has shrunk by over $130 billion in 2025 alone.

One Tesla investor shared his story on Reddit, revealing that his 58-year-old father put his entire 401(k) into Tesla stock, only to watch it plummet. This highlights the dangers of over-concentrating investments in a single stock. While some Tesla bulls see this as a buying opportunity, others are rethinking their strategy. The stock’s high volatility has tested even the most loyal supporters, leading many to reconsider their exposure to Tesla.

Key Lessons for Investors

If you’ve been caught in Tesla’s stock decline, don’t panic—this is an opportunity to learn and adjust your investment strategy. Here are the key takeaways:

1. Don’t Panic Sell—Assess the Bigger Picture

Market downturns can be scary, but knee-jerk reactions often lead to poor decisions. Before selling your Tesla shares, take a step back and analyze whether Tesla’s long-term potential remains strong. Ask yourself:

- Has the company’s long-term growth outlook changed?

- Are Tesla’s innovations (like self-driving technology) still promising?

- Is this just a short-term dip, or a deeper problem?

If you still believe in Tesla’s future, it may be wise to hold your shares instead of selling at a loss. However, if Tesla’s fundamentals no longer align with your investment goals, trimming your position on a rebound could be a smart move.

2. Diversify Your Portfolio

Tesla’s stock crash is a classic example of why diversification is crucial. Financial advisors recommend that no single stock should make up more than 5-10% of your portfolio. A well-diversified portfolio reduces the risk of catastrophic losses when one stock crashes. If Tesla’s decline significantly hurt your portfolio, consider reallocating your investments across different sectors like:

- Technology (Apple, Microsoft, Google)

- Healthcare (Pfizer, Johnson & Johnson)

- Finance (JPMorgan, Visa)

- Energy (ExxonMobil, NextEra Energy)

By spreading your investments, you protect yourself from the risk of any one company’s stock plunging.

3. Rebalance Your Portfolio Regularly

Tesla’s dramatic rise in 2023 may have led some investors to over-allocate their holdings to TSLA. Rebalancing ensures that your portfolio maintains its intended risk level.

Example: If Tesla originally made up 10% of your portfolio but grew to 30% during its peak, selling a portion before the crash would have locked in gains and reduced risk.

4. Focus on Fundamentals, Not Just Hype

At its peak, Tesla’s stock price implied nearly flawless execution and unstoppable growth. However, stock prices can detach from reality when fueled by hype. Investors should always analyze the company’s actual performance, including:

- Sales and revenue growth

- Profitability and margins

- Competitive position in the market

- Leadership decisions and strategic direction

Ignoring these fundamentals can lead to overpaying for a stock, which makes downturns even more painful.

5. Have an Exit Strategy

Tesla’s volatility highlights the importance of knowing when to sell a stock. Some useful exit strategies include:

- Setting a Price Target: Sell a portion of your shares when the stock hits a specific high.

- Stop-Loss Orders: Automatically sell shares if they fall below a certain price to limit losses.

- Selling on Fundamental Changes: If Tesla’s core business deteriorates, it may be time to exit.

Having a well-defined exit strategy prevents emotional decision-making during market turmoil.

Tesla’s 50% stock drop has been a harsh reminder that even market darlings can experience massive sell-offs. While some investors remain bullish, others have been forced to rethink their investment approach. If you’re holding Tesla stock, ask yourself: Are you comfortable with the volatility? If you still believe in Tesla’s long-term vision, it may be worth riding out the storm. However, if the stock’s wild swings have kept you up at night, consider reducing your exposure and diversifying your investments.

Regardless of whether Tesla rebounds or faces further declines, this event has reinforced essential investing lessons:

- Diversify your portfolio to reduce risk

- Don’t make investment decisions based on hype

- Rebalance your holdings periodically

- Have an exit strategy before a crisis hits

Investing is a long game. Stay disciplined, manage your risk, and focus on the bigger picture. Whether Tesla recovers or not, these lessons will help you weather any storm in the stock market.

Related Post