EV sales in the U.S. and Europe have hit a period of slower growth, creating uncertainty in the market.

Despite the sensational headlines, the electric vehicle (EV) industry is far from dead. However, EV sales in the U.S. and Europe have hit a period of slower growth, creating uncertainty in the market. The latest Mobility Consumer Index from consulting firm EY provides valuable insights into the current EV landscape, based on a survey of nearly 20,000 consumers across 28 countries.

Key Takeaways:

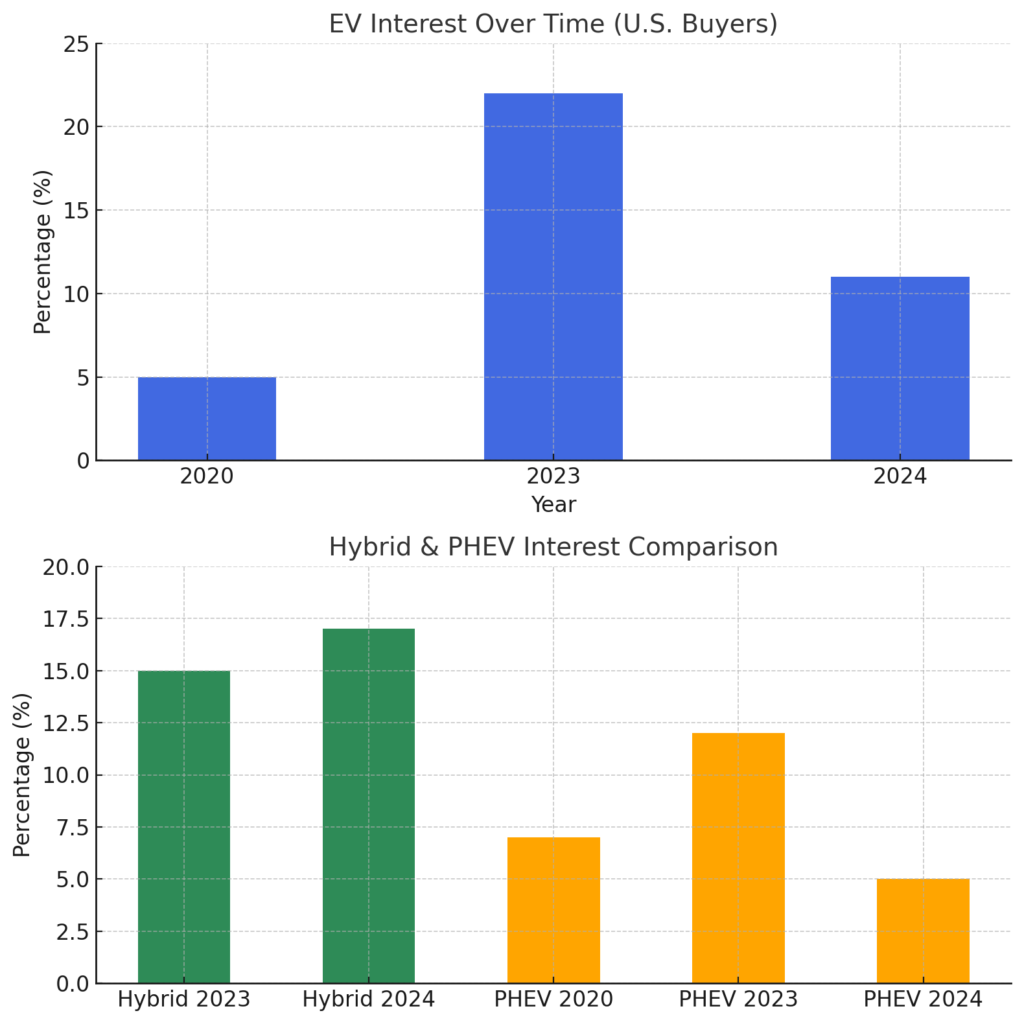

- U.S. EV Buying Intent Drops: Only 11% of U.S. consumers plan to purchase an EV in the next two years, down from 22% in 2023.

- Broader Economic Factors: Rising interest rates, inflation, and the high cost of new cars are affecting car-buying decisions.

- Shifting Concerns: Battery replacement costs are now a top concern, overtaking traditional worries about charging infrastructure and range.

- Hybrids on the Rise: As consumers look for affordable alternatives, hybrids are gaining momentum.

What’s Behind the Drop in EV Demand?

According to Steve Patton, head of EY’s Americas automotive practice, the decline in U.S. EV buying intent is not entirely unexpected. The jump from 7% to 22% interest in EVs in 2023 was unprecedented, largely driven by heavy investment in EV infrastructure, new model launches, and increased awareness. However, this surge has since tapered off to 11% in 2024, reflecting economic challenges like inflation and high interest rates.

“Consumers are more hesitant to spend big on new technology, especially when traditional internal combustion engine (ICE) vehicles are cheaper,” Patton explained.

Economic Pressures and Consumer Hesitation

EY’s data reveals that the overall percentage of Americans planning to buy a new car dropped from 60% in 2023 to 50% in 2024. With new cars becoming increasingly expensive, it’s no surprise that many consumers are reluctant to embrace EVs, which typically come with higher price tags than their gas-powered counterparts.

EV Consideration Over Time

| Year | EV Buying Intent (%) | Total Car Buying Intent (%) |

|---|---|---|

| 2020 | 5% | 60% |

| 2022 | 7% | 55% |

| 2023 | 22% | 60% |

| 2024 | 11% | 50% |

Changing Perceptions of EVs

Interestingly, the main concerns about EVs have shifted. In the past, consumers were worried about range and the availability of charging stations. While those issues still exist, they are no longer the top worries. EY’s 2024 survey found that the high cost of battery replacement is now the biggest deterrent for potential EV buyers, with 26% citing this concern.

Top 5 EV Concerns (EY 2024 Survey):

- Expensive battery replacement – 26%

- Public charging availability – 25%

- Limited EV range – 24%

- Lack of urban charging stations – 23%

- Charging system compatibility – 22%

This shift in concerns highlights a growing consumer education problem. While the fear of costly battery replacements is real—some replacements can exceed $20,000—these incidents are rare. Addressing these concerns through consumer education or offering battery-as-a-service options could help reduce the fear around EV ownership.

Rise of Hybrids as a Middle Ground

While EV demand may be fluctuating, hybrids are gaining popularity as a more affordable and accessible option for consumers. Hybrids provide the benefits of electric driving without the challenges that come with full EVs, such as charging infrastructure. According to the EY study, 17% of U.S. buyers are considering hybrids, up from 15% in 2023.

This rise in hybrid interest could indicate that consumers see hybrids as a stepping stone toward full electrification, especially as economic pressures mount.

A Closer Look at Hybrid and Plug-in Hybrid Trends

| Vehicle Type | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|

| Hybrid | 14% | 16% | 15% | 17% |

| Plug-in Hybrid (PHEV) | 6% | 7% | 12% | 5% |

Hybrids continue to gain momentum, while interest in plug-in hybrids (PHEVs) has dipped to 5%, from 12% in 2023. Despite renewed interest from automakers like General Motors in plug-in hybrids, consumers still view them as a niche technology with similar infrastructure challenges to full EVs.

Here are two bar graphs:

Hybrid & PHEV Interest Comparison: This compares interest in hybrid and plug-in hybrid vehicles (PHEVs) over the same period, showing a slight increase in hybrid interest and a decrease in PHEV interest.

EV Interest Over Time (U.S. Buyers): This shows the percentage of U.S. car buyers considering EV purchases from 2020 to 2024, highlighting the peak in 2023 and the drop in 2024.

New Concerns About EVs

In the past, potential buyers were most concerned about the range of EVs and the availability of charging stations. Now, a new concern has emerged: the high cost of battery replacement. EY’s study found that 26% of respondents are worried about the cost of replacing an EV battery, which can exceed $20,000. While these concerns may be overstated—battery replacements are rare—such fears are slowing down EV adoption.

Top Concerns About EVs in 2024

| Concern | Percentage of Respondents |

|---|---|

| High cost of battery replacement | 26% |

| Availability of public chargers | 25% |

| Limited EV range | 24% |

| Lack of charging stations | 23% |

| Charging interoperability issues | 22% |

The Road Ahead for EVs and Hybrids

As Steve Patton suggests, hybrids may stick around longer than initially expected, especially given the challenges facing full battery-electric vehicles (BEVs) in the U.S. While hybrids serve as a bridge to full electrification, the journey towards widespread EV adoption may take longer than anticipated.

In conclusion, while the EV market is facing headwinds, it’s far from over. Economic pressures, shifting consumer perceptions, and concerns over costs are all playing a role in the current slowdown. However, the broader trajectory still points towards a future where electric vehicles play a significant role in our transportation landscape.

The EV Journey is Far From Over

While the EV market has slowed, it’s important to remember that this shift is not indicative of a dying industry. Long-term demand for EVs is still growing, and innovations in technology, battery life, and charging infrastructure will continue to shape the future of transportation. Hybrids offer a compelling alternative for consumers who aren’t ready to fully embrace electric vehicles, but the move toward electrification remains inevitable.

The EV industry might be facing temporary setbacks, but the road ahead is still paved with potential.

Related Post