Electric vehicles (EVs) have been at the center of automotive conversations for a while now.

Electric vehicles (EVs) have been at the center of automotive conversations for a while now. But with so much conflicting information about their future, it’s hard to know who or what to believe. Some claim that EV sales are plummeting and that the transition to zero-emission vehicles has failed. Others insist that EV sales are booming, with data to back it up.

So, what’s really going on? A recent study from J.D. Power gives us some answers, showing that while EV sales are indeed growing, the adoption rate is slower than expected. Let’s break down the factors contributing to this trend and what it means for the future of electric vehicles.

Key Points

- EV adoption rates are growing, but slower than anticipated.

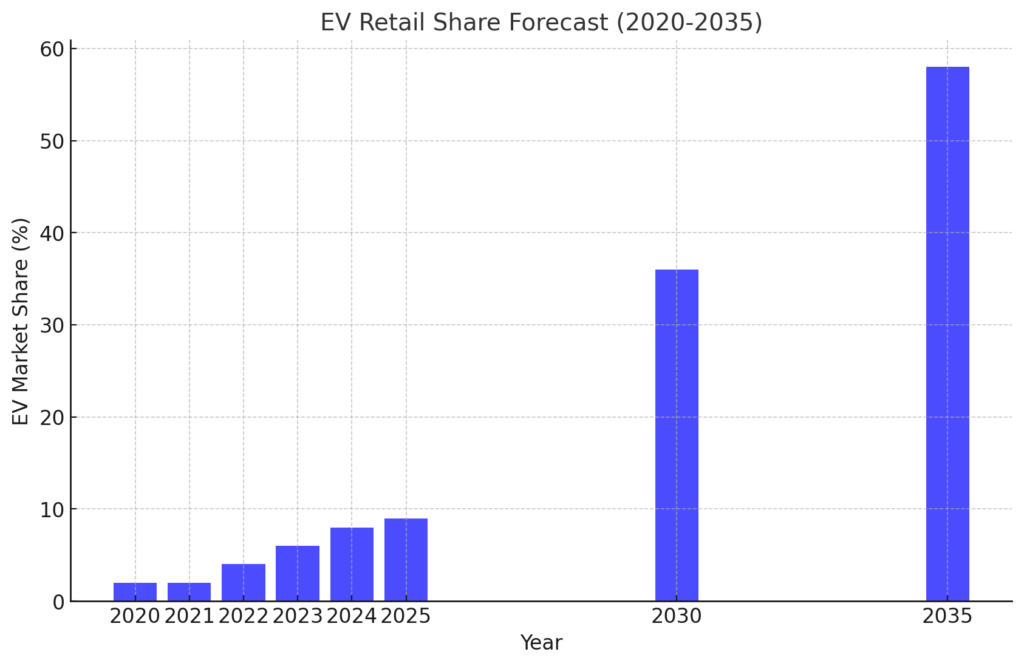

- J.D. Power revised its forecast: EVs are now expected to make up 9% of new car sales by 2025 (down from the original 12%).

- By 2030, EVs are predicted to account for 36% of all new car sales, increasing to 58% by 2035.

- Plug-in hybrid vehicles (PHEVs) are seeing temporary growth, but may not sustain long-term success.

- Public charging infrastructure remains a major hurdle for faster EV adoption.

- Affordability of EVs has improved, thanks to incentives and leasing options.

EV Adoption Forecasts

| Year | Original Forecast (EVs as % of new car sales) | Revised Forecast (EVs as % of new car sales) |

|---|---|---|

| 2025 | 12% | 9% |

| 2030 | 36% | 36% |

| 2035 | 58% | 58% |

Why the Slowdown in EV Adoption?

J.D. Power outlines several factors slowing down the transition to EVs. Here’s a closer look:

1. Rise of Plug-in Hybrids (PHEVs)

Plug-in hybrid electric vehicles (PHEVs) are gaining more attention. In fact, their market share jumped from 0.6% in 2020 to 1.8% in 2024. While this may seem like a good thing, it’s slowing the move to fully electric vehicles (BEVs). However, PHEVs typically score lower in user satisfaction, and J.D. Power believes this growth is only temporary.

| Vehicle Type | Market Share (2024) | Market Share (2020) |

|---|---|---|

| Hybrid EVs (HEVs) | 8.6% | – |

| Battery EVs (BEVs) | 8.4% | – |

| Plug-in Hybrids (PHEVs) | 1.8% | 0.6% |

2. Challenges in Public Charging Infrastructure

While home charging is beloved by EV owners, public charging remains a big issue. J.D. Power says that public charging has slightly improved in 2024, but it still falls short, with most users describing it as moving from “terrible” to merely “bad.” Until the U.S. improves its Level 2 and DC fast charging infrastructure, EV adoption will continue to face headwinds.

3. Affordability Is Getting Better

Despite the slowdown in adoption, there’s good news on the affordability front. Due to incentives and leasing options, 66% of U.S. drivers now have access to a reasonably priced EV alternative to their gas-powered vehicles. In fact, 72% of mass-market EVs are leased, often benefiting from the Inflation Reduction Act’s $7,500 incentive, making EV ownership more affordable than ever before.

EV Affordability Factors

| Factor | Impact on Affordability |

|---|---|

| Leasing Programs | 72% of mass-market EVs leased |

| Inflation Reduction Act | $7,500 EV purchase incentive |

| Improved Pricing | 66% of drivers can afford EVs |

What’s Next for EV Growth?

J.D. Power’s data shows that 94% of battery electric vehicle (BEV) owners plan to buy another EV when their current lease expires. This loyalty suggests that, once the charging infrastructure and affordability improve, the pace of EV adoption will accelerate again.

Concerns for Automakers

While consumers seem to be warming up to the idea of EVs, automakers are pulling back from ambitious EV plans. Some automakers are struggling to make their EVs profitable, especially at lower price points. This challenge has led experts to question whether affordable, mass-produced EVs are feasible from established carmakers.

The China Factor

China’s EV market has become a hot topic, as Chinese brands like BYD and Xpeng produce low-cost electric cars that could disrupt the global market. If Chinese EVs enter the U.S. market, it remains unclear how American automakers and the government will respond.

The Future of EVs is Still Bright

Despite the current challenges, the future of electric vehicles looks promising. As infrastructure and affordability continue to improve, EV adoption will increase. While there are some roadblocks in the short term, EV sales are still growing, and the auto industry is slowly but surely shifting toward an electric future.

In the meantime, the focus should be on improving public charging options and making EVs more affordable for a broader range of drivers. These are key factors that will ultimately determine the success of the EV revolution.

Charging Infrastructure Improvements Timeline: Key Milestones for EV Growth

Improving EV charging infrastructure is critical to accelerating the adoption of electric vehicles. As highlighted by J.D. Power and other industry reports, public charging remains one of the biggest challenges, but progress is being made. Here’s a look at the expected timeline for improvements in charging infrastructure:

| Year | Key Milestones for Charging Infrastructure |

|---|---|

| 2024-2025 | – Focus on expanding Level 2 and DC fast charging stations. – Improvements in public charging experience (from “terrible” to “bad”). |

| 2026-2027 | – Government incentives encourage private companies to build more chargers. – Start of nationwide network development for EV charging. |

| 2028-2030 | – Significant expansion of urban and rural charging stations. – Faster charging technology emerges, reducing charging times further. |

| 2030-2035 | – Widespread access to fast and reliable public charging. – Smart grid integration for more efficient charging and energy management. |

2024-2025: Early Improvements

- Level 2 and DC fast chargers are becoming more common, but the user experience is still subpar. Expect improvements to go from “terrible” to “bad” as more stations are built and reliability is enhanced.

- Many companies are receiving government support to invest in charging networks, especially in urban and high-traffic areas.

2026-2027: Expansion Efforts

- The U.S. government is pushing forward with infrastructure incentives, driving the expansion of chargers across highways, shopping centers, and rural areas.

- Private companies will step in, developing faster chargers and improving the public charging experience.

2028-2030: Major Breakthroughs

- By this time, a wider variety of EV models will be available, creating greater demand for more accessible charging stations.

- Faster charging technology emerges, allowing for quicker recharges and reducing wait times.

2030-2035: Widespread and Reliable Charging

- Massive public networks will cover both urban and rural areas, giving EV owners reliable access to fast chargers across the country.

- Smart grid systems will be implemented, allowing for better energy management and ensuring that charging infrastructure is both sustainable and efficient.

Here is the bar graph representing the EV retail share forecast from 2020 to 2035. It shows the projected increase in electric vehicle market share, starting from 2% in 2020 and reaching up to 58% by 2035. The data highlights significant growth over the years, with the most substantial rise occurring between 2025 and 2035.

As charging infrastructure improves over the next decade, more drivers will confidently switch to EVs, knowing they can reliably charge their vehicles on the go. The timeline shows how critical infrastructure development is to meeting future EV demand.

Related Post

- The 2025 Toyota Stout: Redefining What a Truck Can Be

- Introducing the 2025 Mini Countryman SE ALL4: A New Era for Mini’s Electric Lineup

- The 2025 Caterpillar Pickup: A Powerful and Advanced Truck with One Major Challenge